Understanding Personal Finance and How to Manage It: A Guide for Self-Employed and Salaried Individuals

Personal finance refers to the management of an individual’s financial activities, including earning, spending, saving, investing, and planning for the future. Effective personal finance management is crucial for achieving financial security and meeting life goals. Understanding Personal Finance This article explores the fundamental concepts of personal finance and provides tailored strategies for both self-employed individuals and salaried employees to manage their finances effectively.

The Basics of Personal Finance

Personal finance encompasses various aspects of an individual’s financial life. Here are the key components:

- Income: Income is the money received from various sources, including salaries, business profits, rental income, dividends, and interest. Managing income effectively involves understanding how much money is coming in and planning how to allocate it efficiently.

- Expenses: Expenses are the money spent on various needs and wants, including housing, utilities, groceries, transportation, entertainment, and other personal needs. Keeping track of expenses helps in identifying unnecessary expenditures and controlling overspending.

- Savings: Savings refer to the portion of income that is not spent and set aside for future use. Savings are crucial for building an emergency fund, making large purchases, and achieving long-term financial goals.

- Investments: Investments are assets purchased with the expectation of generating income or appreciation over time. Common investment options include stocks, bonds, mutual funds, real estate, and retirement accounts.

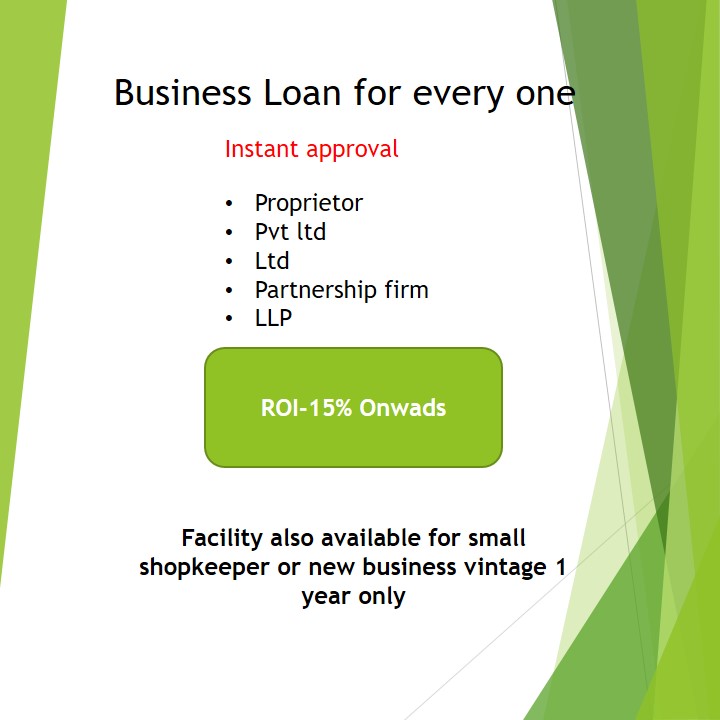

- Debt Management: Debt includes money borrowed through loans, credit cards, and mortgages. Effective debt management involves understanding interest rates, repayment terms, and prioritizing debt repayment to avoid financial stress.

- Insurance: Insurance provides financial protection against unexpected events such as illness, accidents, or loss of property. Types of insurance include health, life, auto, home, and disability insurance.

- Retirement Planning: Retirement planning involves setting aside funds and investing for the period when one is no longer working. This ensures financial security and independence during retirement years.

Financial Planning for Self-Employed Individuals

Self-employed individuals face unique financial challenges and opportunities. Here are strategies to manage personal finances effectively:

- Income Stability: Self-employed individuals often have fluctuating incomes. It is crucial to create a budget that accounts for variable income and to maintain a steady cash flow. Setting aside a portion of high-income months can help manage lean periods.

- Expense Tracking: Keeping meticulous records of both business and personal expenses is essential. Using accounting software or apps can help track expenses and identify areas where costs can be reduced.

- Emergency Fund: An emergency fund is crucial for self-employed individuals to cover unexpected expenses or periods of low income. Aim to save at least six months’ worth of living expenses in a liquid and easily accessible account.

- Tax Planning: Self-employed individuals are responsible for their own tax filings, including estimated quarterly tax payments. Keeping accurate records of income and expenses and working with a tax professional can help minimize tax liabilities and avoid penalties.

- Retirement Savings: Unlike salaried employees, self-employed individuals do not have access to employer-sponsored retirement plans. Opening and contributing to retirement accounts such as a Self-Employed Pension (SEP) IRA, Solo 401(k), or a Simple IRA can help build a retirement nest egg.

- Insurance Coverage: Obtaining adequate insurance coverage is vital for financial protection. This includes health insurance, life insurance, disability insurance, and business liability insurance.

- Investment Diversification: Diversifying investments helps manage risk and ensures a balanced portfolio. Investing in a mix of stocks, bonds, mutual funds, and real estate can provide long-term growth and income.

Financial Planning for Salaried Employees

Salaried employees have a more predictable income stream, but they also need to manage their finances carefully. Here are strategies for salaried individuals:

- Budgeting: Creating a monthly budget helps in tracking income and expenses. Categorize spending into essential and discretionary expenses to identify areas for savings.

- Automatic Savings: Automating savings can ensure consistent contributions to savings accounts and investment plans. Setting up automatic transfers to savings and investment accounts can help build wealth over time.

- Emergency Fund: An emergency fund is essential for salaried employees to cover unexpected expenses such as medical emergencies, job loss, or major repairs. Aim to save three to six months’ worth of living expenses.

- Debt Management: Prioritize paying off high-interest debt, such as credit card balances. Consider consolidating loans or refinancing to lower interest rates and reduce monthly payments.

- Retirement Planning: Take full advantage of employer-sponsored retirement plans such as the Employees’ Provident Fund (EPF) and National Pension System (NPS). Contribute at least enough to get the full employer match, if available. Additionally, consider opening a Public Provident Fund (PPF) or investing in mutual funds for retirement savings.

- Insurance Coverage: Ensure adequate insurance coverage, including health, life, and disability insurance. Review and update policies regularly to ensure they meet current needs.

- Investment Strategies: Diversify investments to balance risk and return. Consider a mix of equity and debt mutual funds, direct equity, fixed deposits, and real estate. Investing in Systematic Investment Plans (SIPs) can help build wealth over time through regular contributions.

Common Financial Tips for Both Self-Employed and Salaried Individuals

- Financial Goals: Set clear short-term and long-term financial goals. Having specific goals helps in creating a focused financial plan and measuring progress.

- Financial Education: Continuously educate yourself about personal finance, investment options, and market trends. This knowledge can help make informed financial decisions.

- Regular Review: Regularly review and update your financial plan. Life events such as marriage, having children, or changes in income require adjustments to your financial strategy.

- Avoid Impulse Spending: Practice mindful spending to avoid unnecessary purchases. Creating a shopping list and sticking to it can help control impulse buying.

- Seek Professional Advice: Consider consulting a financial advisor or planner to create a personalized financial plan. Professionals can provide valuable insights and help optimize your financial strategy.

Example: Managing Personal Finance for a Self-Employed Individual

Raj, a freelance graphic designer, has an irregular income. Here’s how he manages his personal finance:

- Income and Expense Tracking: Raj uses accounting software to track his income and categorize his expenses into business and personal expenses.

- Budgeting: He creates a budget that includes essential expenses like rent, utilities, groceries, and discretionary expenses like dining out and entertainment. Raj sets aside a portion of his income from high-earning months to cover lean periods.

- Emergency Fund: Raj maintains an emergency fund equivalent to six months of living expenses in a high-yield savings account.

- Tax Planning: Raj works with a tax professional to ensure he makes timely estimated tax payments and maximizes deductions for business expenses.

- Retirement Savings: He contributes to a SEP IRA, taking advantage of higher contribution limits for self-employed individuals.

- Insurance: Raj has health insurance, life insurance, and business liability insurance to protect against unforeseen events.

- Investments: Raj invests in a diversified portfolio of mutual funds and stocks through SIPs, ensuring consistent contributions and long-term growth.

Example: Managing Personal Finance for a Salaried Employee

Anita, a marketing manager with a stable monthly salary, manages her personal finance as follows:

- Budgeting: Anita creates a detailed monthly budget, allocating funds for essentials, savings, investments, and discretionary spending.

- Automatic Savings: She sets up automatic transfers to her savings account and investment accounts, ensuring regular contributions.

- Emergency Fund: Anita maintains an emergency fund with three months’ worth of expenses in a liquid savings account.

- Debt Management: She focuses on paying off her credit card debt with the highest interest rate first and makes regular payments on her home loan.

- Retirement Planning: Anita contributes to her EPF and NPS accounts and also invests in a PPF for additional retirement savings.

- Insurance: She has comprehensive health insurance, life insurance, and disability insurance to protect her and her family.

- Investments: Anita invests in a mix of equity and debt mutual funds through SIPs, ensuring a balanced portfolio that aligns with her risk tolerance and financial goals.

Conclusion

Effective personal finance management is crucial for achieving financial stability and long-term success, regardless of whether one is self-employed or a salaried employee. By understanding the key components of personal finance and implementing tailored strategies, individuals can navigate financial challenges, build wealth, and secure their financial future. Whether through budgeting, saving, investing, or seeking professional advice, the path to financial well-being starts with informed and proactive financial planning.