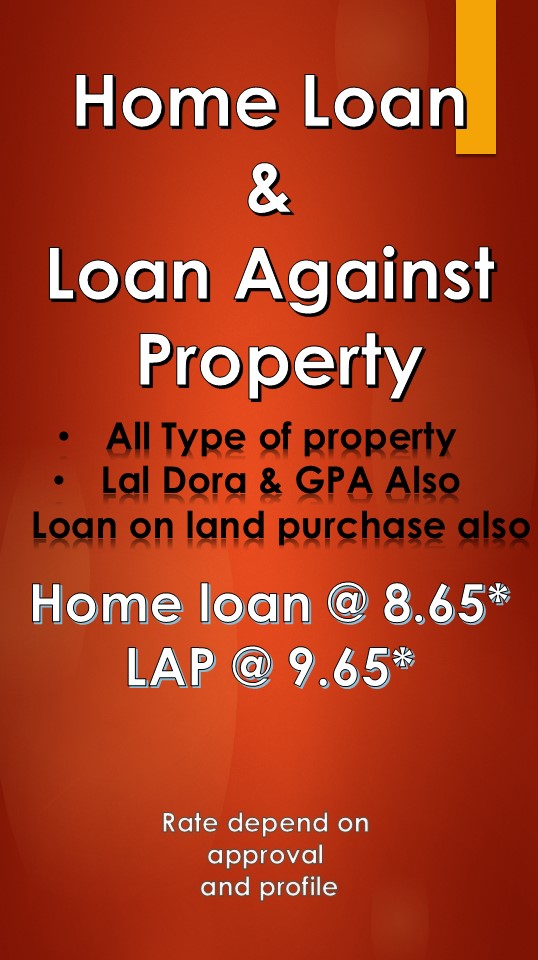

Personal Loans in South Delhi: A Comprehensive Guide

Introduction

Personal loans are an essential financial product that allows individuals to meet various needs, such as medical emergencies, education expenses, home renovations, or even vacations. South Delhi, comprising areas like Mahipalpur, Mehrauli, Chhatarpur, Saket, Deoli, Dr. Ambedkar Nagar, Madan Gir, Tughlakabad, Sangam Vihar, Badarpur, and Harkesh Nagar, Personal Loans in South Delhi A Comprehensive Guide offers a unique landscape for personal loans due to its mix of residential, commercial, and historical significance.

Understanding Personal Loans

Personal loans are unsecured loans provided by banks and financial institutions based on the borrower's creditworthiness and income. Unlike home or auto loans, personal loans do not require collateral, making them accessible yet requiring responsible borrowing.

Eligibility Criteria

General Requirements

- Age: Typically between 21 to 60 years.

- Income: Steady source of income, with minimum thresholds varying by lender.

- Employment Status: Both salaried and self-employed individuals are eligible.

- Credit Score: A good credit score (typically 750+) is crucial for favorable terms.

Loan Process

Application Procedure

- Application Form: Fill out the lender's personal loan application form.

- Documentation: Submit necessary documents such as ID proof, address proof, income proof (salary slips, bank statements), and employment proof.

Approval and Disbursement

- Verification: The lender verifies the provided documents and credit history.

- Approval: Based on verification, the loan amount and terms are approved.

- Disbursement: The loan amount is credited to the borrower's bank account.

Interest Rates and Repayment

Interest Rates

- Vary between 10% to 24% per annum, depending on the lender and borrower’s profile.

- Fixed vs. floating interest rates options.

Repayment Tenure

- Typically ranges from 1 to 5 years.

- Flexible repayment plans to suit borrower’s financial capability.

Locality-wise Insights

Mahipalpur

- Overview: Proximity to the airport and presence of numerous hotels and commercial establishments.

- Loan Demand: High due to business activities and transient population.

- Preferred Lenders: Major banks and NBFCs offer competitive personal loan products.

Mehrauli

- Historical Significance: Home to Qutub Minar and other landmarks.

- Residential Appeal: Growing demand for loans due to residential expansions.

- Market Trends: Stable real estate market influences loan terms.

Chhatarpur

- Residential Hub: Mix of affluent and middle-class housing.

- Loan Offerings: Attractive loan packages for home renovations and personal needs.

- Interest Rates: Competitive rates from various lenders.

Saket

- Commercial and Residential Mix: Presence of malls, office complexes, and upscale residences.

- Loan Demand: High due to lifestyle and business needs.

- Key Players: Leading banks and fintech companies.

Deoli

- Emerging Area: Rapid development with growing infrastructure.

- Loan Prospects: Increasing demand for personal loans for home improvement and business expansion.

- Lenders: Wide range of lenders offering varied loan products.

Dr. Ambedkar Nagar

- Residential Area: Predominantly residential with a diverse population.

- Loan Utilization: Primarily for educational expenses, home repairs, and emergencies.

- Interest Rates: Affordable rates from cooperative banks and NBFCs.

Madan Gir

- Community Focused: Dense population with close-knit community living.

- Loan Needs: Small personal loans for immediate financial needs.

- Preferred Institutions: Local banks and cooperative societies.

Tughlakabad

- Historical Area: Known for Tughlakabad Fort and significant residential development.

- Loan Applications: For both personal and business-related purposes.

- Lending Options: Varied options from traditional banks to modern fintech lenders.

Sangam Vihar

- Largest Unauthorized Colony: Significant population with diverse loan needs.

- Loan Accessibility: Challenges due to legal status but increasing microfinance options.

- Focus Areas: Small personal loans and emergency funding.

Badarpur

- Industrial and Residential Mix: Presence of both residential areas and industrial zones.

- Loan Demand: For both personal consumption and small business needs.

- Key Lenders: Banks, NBFCs, and microfinance institutions.

Harkesh Nagar

- Residential Locality: Predominantly residential with emerging commercial spots.

- Loan Utilization: Home improvements, education, and medical emergencies.

- Interest Rates: Competitive rates from various financial institutions.

Benefits of Personal Loans

- Flexibility: No restriction on end-use.

- Quick Disbursement: Faster processing and disbursement compared to other loans.

- Unsecured: No collateral required.

- Credit Building: Timely repayments improve credit score.

Risks and Considerations

- High-Interest Rates: Compared to secured loans.

- Debt Trap: Risk of over-borrowing and default.

- Credit Score Impact: Missed payments can negatively affect credit score.

- Proper Assessment: Evaluate repayment capability before borrowing.

Tips for Borrowers

- Compare Offers: Thoroughly compare interest rates and terms from different lenders.

- Read the Fine Print: Understand all terms and conditions before signing.

- Maintain a Good Credit Score: Pay bills on time and keep credit utilization low.

- Plan Repayments: Choose an EMI amount that fits comfortably within your budget.

- Consult Financial Advisors: For better loan management and financial planning.

Conclusion

Personal loans offer a lifeline for various financial needs, especially in the diverse and dynamic regions of South Delhi. From Mahipalpur to Harkesh Nagar, residents have access to a variety of personal loan options tailored to their specific requirements. By understanding the loan process, eligibility criteria, and local market conditions, borrowers can make informed decisions and manage their finances effectively.