Personal Loans in Allahabad Prayagraj

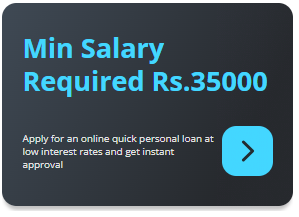

Conquering Your Financial Needs: Personal Loans in Allahabad-PrayagrajDo you reside in Allahabad, now officially known as Prayagraj, and require financial assistance to fulfill your aspirations? Look no further than Loan7D.com, your one-stop solution for acquiring a hassle-free personal loan! We, at Loan7D.com, understand that unforeseen expenses or planned endeavors can sometimes demand a financial boost. That's why we've built a robust network of trusted banks and NBFCs (Non-Banking Financial Companies) in Allahabad-Prayagraj, offering a diverse range of personal loan options to suit your specific needs.

What is a Personal Loan?

A personal loan is an unsecured loan, meaning it doesn't require any collateral like property or vehicles. This makes it a convenient and accessible option for various personal expenses, including:

- Medical emergencies: Unexpected medical bills can be a financial burden. A personal loan can provide the necessary funds for treatment and recovery without stressing your savings.

- Education expenses: Investing in your education or your children's education can be expensive. A personal loan can bridge the gap between your savings and tuition fees, books, or other educational costs.

- Wedding expenses: Weddings can be grand affairs. A personal loan can help cover wedding venue costs, catering, decorations, and other associated expenses.

- Debt consolidation: Managing multiple debts with varying interest rates can be overwhelming. A personal loan can help consolidate these debts into a single loan with a potentially lower interest rate, simplifying your repayment process.

- Home improvement: Planning renovations or upgrades to your home? A personal loan can finance necessary repairs, remodeling, or appliance purchases.

- Travel: Traveling broadens your horizons. A personal loan can help finance your dream vacation or a much-needed getaway.

Why Choose Loan7D.com for Your Personal Loan in Allahabad-Prayagraj?

At Loan7D.com, we pride ourselves on being your trusted financial partner. Here's what sets us apart:

- Extensive Network: We have partnered with leading banks and NBFCs in Allahabad-Prayagraj, providing you with a wider range of loan options to choose from. This ensures you get the best possible interest rates and terms that align with your needs.

- Minimum Rates: Our strong relationships with lenders allow us to negotiate competitive interest rates on your behalf. We strive to secure you a personal loan with the minimum possible interest rate, saving you money in the long run.

- Minimal Processing Fees: Understanding the importance of affordability, we prioritize loans with minimal processing fees. This way, you get the maximum loan amount disbursed to you.

- Hassle-Free Process: Our streamlined process eliminates the complexities of loan applications. We guide you throughout the process, ensuring a smooth and efficient experience.

- Expert Guidance: Our team of experienced loan consultants is readily available to answer your questions, address your concerns, and recommend the best loan options for your unique situation.

Steps to Acquire a Personal Loan with Loan7D.com:

- Contact Us: Reach out to our friendly loan consultants via phone call, email, or by visiting our office in Allahabad-Prayagraj.

- Discuss Your Needs: Our consultants will listen to your specific requirements, loan amount, and repayment capabilities.

- Document Collection: We will assist you in gathering the necessary documents for your loan application, streamlining the process.

- Application Processing: Our team will handle your loan application submission to multiple lenders, ensuring you receive the best possible offers.

- Loan Approval & Disbursement: Once your loan is approved, we will walk you through the terms and conditions before disbursing the loan amount directly to your bank account.

Documents Required for a Personal Loan Application (may vary depending on lender):

- KYC documents (identity and address proof)

- Salary slips (for salaried individuals) or bank statements (for self-employed individuals)

- Income tax returns (ITR) for the past few years (may be required)

- Employment proof (for salaried individuals)

Essential Factors to Consider When Choosing a Personal Loan:

- Interest Rate: The interest rate is a crucial factor as it directly impacts the total loan cost. Opt for the lowest interest rate possible.

- Processing Fee: Compare processing fees across lenders. Choose a loan with a minimal processing fee to maximize the amount you receive.

- Repayment Tenure: Select a repayment tenure that aligns with your financial comfort. Longer tenures will result in lower EMIs (Equal Monthly Installments) but higher total interest paid.

- Prepayment Penalty: Some lenders charge a penalty for early loan closure. Choose a loan with no prepayment penalty