Naveen Sinha

In the ever-evolving landscape of Indian fashion retail, Tata Group’s Zudio has emerged as a game-changer, disrupting and challenging international giants like H&M and Zara. Within a span of a year, Zudio has reshaped market dynamics with a strategic approach that focuses on aggressive expansion, competitive pricing, and operational efficiency, positioning itself as a formidable player in the fast fashion segment. This article delves into the factors that have propelled Zudio to the forefront, its financial performance, and the impact on competitors.

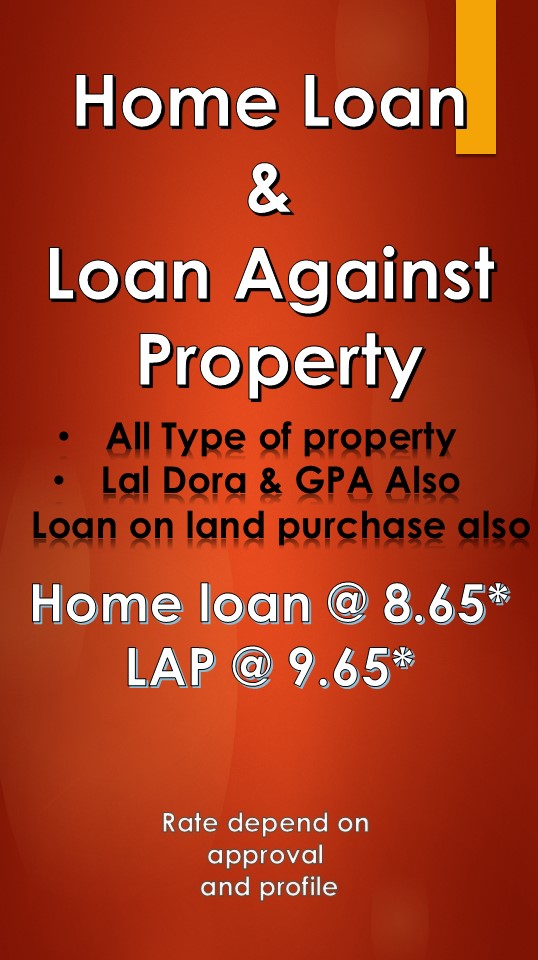

Aggressive Expansion Strategy and Market PenetrationZudio’s expansion strategy has been instrumental in its rapid rise. During the fiscal year 2023-2024, the brand opened over 200 new stores, expanding its reach to over 890 outlets across 178 cities. This growth has allowed Zudio to tap into a diverse customer base, particularly in tier 2 and tier 3 cities, where demand for affordable and stylish apparel is on the rise. By strategically choosing store locations and investing in high-traffic areas, Zudio has maximized its visibility and accessibility. The brand’s focus on serving a broader audience, including smaller towns and cities, has proven to be a key differentiator. While global brands like H&M and Zara have traditionally targeted urban and metropolitan consumers, Zudio’s inclusive approach caters to the aspirational shopper in underserved regions. This localized strategy has allowed Zudio to build a loyal customer base and increase foot traffic in its stores.

Financial Performance and Impressive Growth Metrics Zudio’s financial success is a reflection of its effective strategy and market understanding. In the fiscal year 2023-2024, the brand’s parent company, Trent Ltd., reported a remarkable 50% increase in overall sales, reaching ₹12,375 crore. Net profit for Trent nearly quadrupled to ₹1,477 crore, showcasing the significant contribution of Zudio to its financial health. Zudio alone accounted for over ₹7,000 crore in revenue, highlighting its role as a key growth driver within the organization. Further reinforcing its robust performance, Trent reported a 46.9% increase in net profit to ₹335.06 crore in the second quarter of the fiscal year, accompanied by a 39% rise in revenue. These metrics underline the effectiveness of Zudio’s operational model and its ability to deliver consistent growth.

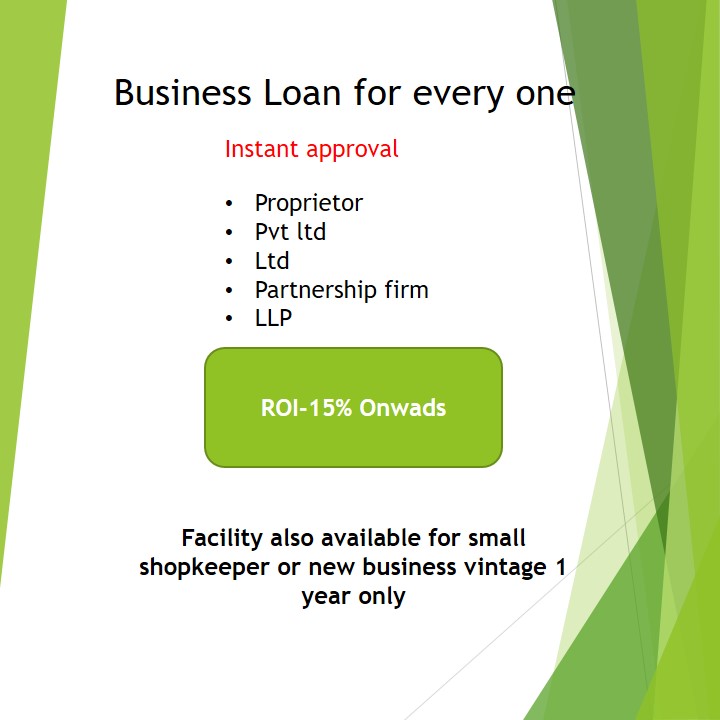

Competitive Pricing and Product Strategy Zudio’s rise can largely be attributed to its value-driven pricing strategy. By offering trendy and high-quality apparel at significantly lower prices than competitors, Zudio has effectively democratized fashion for Indian consumers. Its product strategy focuses on delivering the latest trends with frequent inventory refreshes, ensuring that customers always find something new and appealing. This not only attracts one-time shoppers but also drives repeat business, fostering brand loyalty. In contrast, brands like H&M and Zara have faced challenges in maintaining their market share. With premium pricing structures and limited penetration in smaller cities, these international brands have struggled to compete with Zudio’s more accessible approach. As a result, Zara reported a 6% decline in revenue to ₹1,562 crore and an 8% drop in net profit to ₹244 crore, indicating the growing influence of local players like Zudio.

Operational Efficiency and Supply Chain Management A cornerstone of Zudio’s success is its operational efficiency. The brand operates with a gross margin of 35-40%, lower than many of its competitors, allowing for higher store productivity. Zudio’s revenue per square foot stands at an impressive ₹16,300, double the industry average. This operational model is driven by a focus on cost management and supply chain control. Zudio maintains end-to-end control over product development and supply chain processes, ensuring timely delivery, quality assurance, and reduced costs. Efficient supply chain management enables Zudio to keep its shelves stocked with the latest styles, minimizing the risk of stockouts or excess inventory. By leveraging technology and analytics, Zudio can respond swiftly to changes in consumer demand, ensuring that it remains agile and responsive in a fast-moving retail environment.

Impact on Competitors and Market Dynamics The rapid ascent of Zudio has had a pronounced impact on international brands and other market players in India. While brands like Zara and H&M initially enjoyed a dominant position in the Indian market, they have faced increasing competition from Zudio’s aggressive growth and appealing pricing. Zara, for instance, has seen declining revenue and profits, highlighting the challenges of competing with a brand that offers similar styles at a fraction of the cost. H&M, known for its sustainable fashion initiatives and premium brand image, has also been affected. The brand has had to reassess its pricing and promotional strategies to remain competitive in a market where price sensitivity is a significant factor. Zudio’s success has forced these international players to rethink their market approach and consider expanding their footprint in smaller cities to match Zudio’s reach.

Future Prospects and Expansion Plans Looking ahead, Zudio is poised for further growth. The brand plans to add 250 more stores in the coming year, aiming to nearly double its current footprint. This expansion aligns with Tata Group’s broader vision of dominating the Indian fashion retail market and catering to the evolving preferences of Indian consumers. With a strategic focus on affordability, style, and accessibility, Zudio is well-positioned to continue its growth trajectory. Moreover, Zudio’s ability to adapt to market trends and consumer preferences will be crucial in maintaining its competitive edge. The brand is expected to continue leveraging data analytics and consumer insights to refine its product offerings and enhance customer experience. By doing so, Zudio can sustain its momentum and further solidify its position as a leader in the fast fashion industry.

Conclusion Zudio’s rapid rise in the Indian fashion retail sector is a testament to its strategic vision, competitive pricing, and efficient operations. By focusing on affordability and inclusivity, the brand has successfully challenged established players like H&M and Zara, reshaping the competitive landscape within a remarkably short period. As Zudio continues to expand and innovate, its influence on the market is likely to grow, setting new benchmarks for success in the fast fashion industry. With ambitious plans for further growth and a commitment to serving diverse customer segments, Zudio is poised to remain a dominant force in the Indian retail market for years to come.

Growth Comparison Chart for Affordable Fashion Brands in India

| Brand/Category | Market Entry Year | Growth Rate (YoY) | Market Share (%) | Target Demographic | Key Strengths |

|---|---|---|---|---|---|

| Zudio | 2016 | 35-40% | 15% | Tier 2 & 3 Cities | Trendy, Budget-Friendly |

| Max Fashion | 2006 | 20-25% | 25% | Middle-Class Families | Affordable, Wide Reach |

| Reliance Trends | 2007 | 30% | 22% | Pan-India | Regional Focus, Affordable |

| H&M (Basics Collection) | 2015 | 10-12% | 10% | Urban Millennials | Global Appeal, Basics Range |

| Regional Players | Varied | 15-20% | 8-12% | Local Consumers | Local Craft, Traditional Design |

| E-commerce Brands | 2010 onwards | 25-30% | 18% | Young Digital Natives | Convenience, Wide Selection |