The Role of ECLGS in Post-Pandemic Business Recovery in India

The COVID-19 pandemic brought unprecedented economic challenges to businesses across the world, and India was no exception. The country’s economy experienced a severe contraction as businesses, especially small and medium enterprises (SMEs), were forced to shut down temporarily due to nationwide lockdowns, disrupted supply chains, and reduced demand for goods and services. Amid these difficult times, the Indian government introduced various relief measures to support businesses, one of the most impactful being the

Emergency Credit Line Guarantee Scheme (ECLGS). Launched in May 2020, ECLGS was designed to provide financial support to distressed businesses, ensuring their survival and recovery in the post-pandemic era.

In this article, we will explore the role of ECLGS in helping businesses recover after the pandemic, its key features, and the overall impact on India’s economy and MSMEs.

What is ECLGS?

The

Emergency Credit Line Guarantee Scheme (ECLGS) was introduced by the Government of India as part of the

Atmanirbhar Bharat Abhiyan in response to the financial strains caused by COVID-19. The scheme is aimed at providing

guaranteed emergency credit to businesses that were struggling due to the pandemic’s economic impact.

The scheme was designed to assist

micro, small, and medium enterprises (MSMEs), along with other eligible sectors like hospitality, aviation, travel, tourism, and healthcare, by offering

collateral-free loans with favorable terms, such as low-interest rates and extended repayment periods.

One of the key features of the scheme is that the

government of India provides a guarantee to the lending institutions for the loans, which means the risk for the lenders is minimized. This has made it easier for businesses to access financial assistance without the need to pledge collateral, a common barrier for smaller businesses seeking loans.

Key Features of ECLGS

The ECLGS is built around the following essential features:

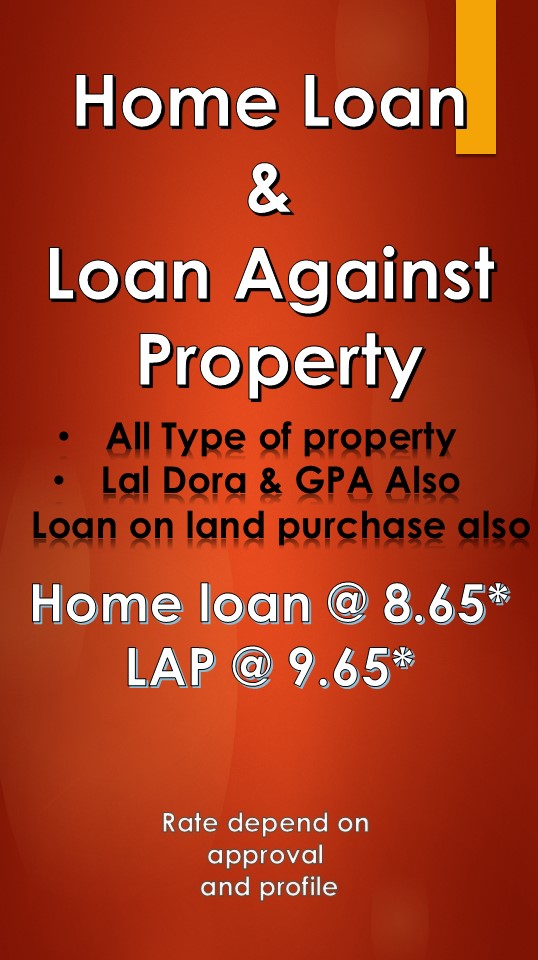

- Loan Amount:

- The maximum loan amount available under ECLGS is up to 20% of the borrower’s outstanding credit as of February 29, 2020, subject to a maximum of ₹500 crore.

- The loan is available in the form of working capital or term loans, providing the flexibility to use it according to business needs.

- Collateral-Free Loans:

- Loans offered under the ECLGS are collateral-free, which is particularly beneficial for MSMEs that may not have sufficient assets to pledge.

- Interest Rates:

- The interest rates are capped, ensuring that businesses are not burdened with high costs. The scheme offers competitive interest rates, significantly lower than what businesses would typically pay for regular loans.

- Repayment Period:

- The repayment period for the loans is up to 5 years, with an initial moratorium period of 12 months, giving businesses more time to stabilize before starting to repay the loan.

- Eligibility:

- The scheme is primarily aimed at MSMEs with an annual turnover of up to ₹250 crore, which are facing financial difficulties due to the pandemic. Businesses from various sectors, including manufacturing, services, and hospitality, are eligible to apply.

- Government Guarantee:

- The loans extended under ECLGS are guaranteed by the Government of India, thereby reducing the risk for lenders and encouraging them to provide loans to distressed businesses.

How ECLGS Helped in Post-Pandemic Recovery

- Providing Immediate Liquidity to Businesses

One of the biggest challenges faced by businesses during the pandemic was the

acute liquidity crunch. With sales falling sharply, businesses struggled to pay salaries, meet operational costs, and maintain inventory. The

ECLGS provided a lifeline by offering instant access to emergency credit, which helped businesses maintain their cash flow during the crisis.

With the immediate infusion of funds, businesses could cover their

working capital requirements, pay employee salaries, clear dues, and resume operations. This financial cushion helped many businesses stay afloat during the initial months of the pandemic when the economy was at a standstill.

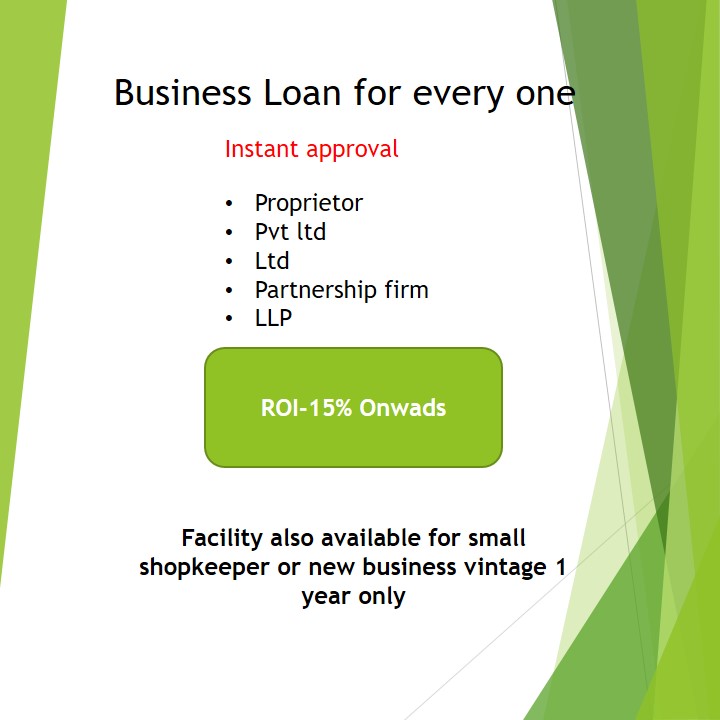

- Supporting MSME Growth and Survival

MSMEs are the backbone of India’s economy, contributing significantly to employment and GDP. However, during the pandemic, they were disproportionately affected due to their

lack of resources, limited access to credit, and dependence on traditional markets. ECLGS was tailored specifically to address the needs of these businesses, offering a much-needed safety net for millions of MSMEs.

By extending

collateral-free loans, the scheme ensured that businesses that lacked tangible assets could still access credit. This was especially important for small enterprises, which are often unable to provide collateral to secure traditional loans. Moreover, with favorable

loan terms and lower interest rates, businesses were better positioned to recover and restart their operations.

- Reviving the Hospitality and Tourism Sectors

Among the most affected sectors during the pandemic were

hospitality and

tourism. Hotels, restaurants, airlines, and travel agencies faced massive revenue losses as travel restrictions and lockdowns were imposed. ECLGS provided crucial support to these industries, which were otherwise at high risk of closure.

The scheme allowed businesses in the hospitality and tourism sectors to access emergency loans that helped them stay operational during the lockdowns and adapt to the new normal. For instance, hotels used the funds to upgrade their facilities, implement health and safety measures, and keep staff employed, while airlines and travel agencies utilized the loans to sustain their operations in the face of reduced demand.

- Encouraging Digital Transformation

The pandemic accelerated the need for businesses to embrace

digital transformation to stay competitive. ECLGS played a role in this by enabling businesses to access funds that could be used for investing in

technology upgrades. This included implementing e-commerce platforms, adopting digital payment solutions, and integrating cloud-based software to streamline operations.

As businesses began to adapt to the online world, the financial support provided by ECLGS helped them build resilience and operate in a rapidly changing environment. This digital shift has also opened new revenue streams for businesses, enhancing their overall growth prospects in the post-pandemic era.

- Rebuilding Employment Opportunities

Small and medium-sized businesses are significant employers in India, and the lockdown led to widespread job losses. By offering liquidity support, the ECLGS allowed many businesses to

retain their employees and continue operations. In the long run, this has helped in preventing large-scale layoffs and contributed to

economic stability.

As businesses began to recover, the ECLGS played a key role in creating an environment conducive to

job creation. For example, manufacturing units that received loans were able to resume production, thereby hiring workers and reviving their supply chains. This, in turn, had a positive impact on the wider economy, as increased employment led to greater consumer spending and overall economic growth.

- Promoting Financial Inclusion

ECLGS also contributed to

financial inclusion by extending credit to businesses that were previously outside the formal banking system. Many MSMEs, particularly those in the informal sector, had limited access to loans from traditional financial institutions. However, the ECLGS, with its simplified application process and government guarantee, made it easier for these businesses to access funding.

By bringing these businesses into the formal credit ecosystem, ECLGS has helped enhance their

financial credibility, making it easier for them to access loans in the future for further growth and expansion.

Challenges and Future Outlook

While ECLGS has had a significant positive impact on the recovery of businesses, there are some challenges that need to be addressed for long-term success. For instance:

- Delayed Loan Disbursements: Some businesses faced delays in loan disbursement due to administrative bottlenecks or documentation issues, which hampered their ability to utilize the funds in a timely manner.

- Loan Repayment Challenges: While the scheme offered a moratorium period, many businesses still face challenges in repaying loans due to slower-than-expected recovery or new economic disruptions.

Moving forward, there is a need for

continuous support and monitoring to ensure that businesses fully benefit from ECLGS and overcome post-pandemic hurdles.

Conclusion

The

ECLGS has been a critical tool in the recovery of businesses in India after the devastating impact of COVID-19. By offering collateral-free loans, easing access to credit, and providing financial stability, the scheme has helped millions of businesses survive and restart operations in the face of overwhelming challenges.

As India continues its recovery journey, the success of ECLGS highlights the importance of timely and well-targeted financial support in enabling businesses to adapt, grow, and thrive in a post-pandemic world. The scheme’s role in enhancing liquidity, preserving jobs, and driving digital transformation underscores the need for sustained government intervention to support India’s economy and MSME sector. With continued policy support and strategic investments, ECLGS can play a crucial role in building a resilient and inclusive economy for the future.