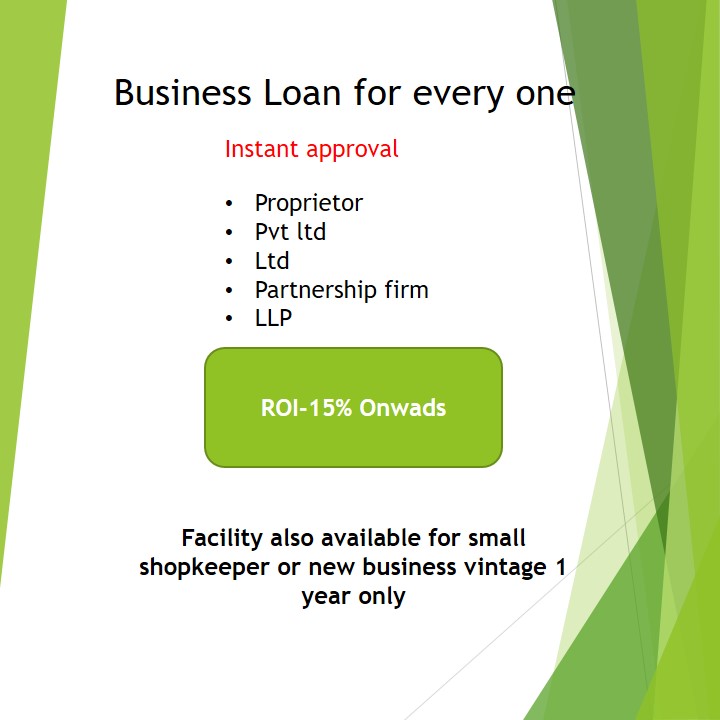

Top Consultants for Business Loan Assistance in Delhi NCR

Securing a business loan can be a daunting task, especially for entrepreneurs navigating the complexities of financial processes. In Delhi NCR, a region bustling with entrepreneurial energy, numerous consultants specialize in providing assistance with business loans. These experts help bridge the gap between business owners and financial institutions by offering tailored solutions, ensuring smooth loan approval processes. This article highlights the top consultants for business loan assistance in Delhi NCR, detailing their services and why they are trusted partners for businesses.

1. FinServe India

Overview: FinServe India is a leading financial consultancy firm that offers end-to-end business loan assistance. With a team of seasoned professionals, they specialize in securing loans for startups, SMEs, and large enterprises.

Key Services:

- Loan application and documentation support.

- Comparison of loan options across multiple banks and NBFCs.

- Advisory on eligibility criteria and credit score improvement.

Why Choose Them: Their strong relationships with major financial institutions ensure quick loan approvals and competitive interest rates.

2. LoanMantra

Overview: LoanMantra is a trusted name in Delhi NCR for business loan consultancy. They focus on providing personalized loan solutions tailored to the unique needs of each business.

Key Services:

- Detailed assessment of financial needs and loan suitability.

- Assistance with government loan schemes like Mudra Yojana and Stand-Up India.

- Support for collateral-based and collateral-free loans.

Why Choose Them: LoanMantra’s customer-centric approach and transparent processes have made them a popular choice among SMEs and startups.

3. Capital First Consultants

Overview: Known for their expertise in financial advisory, Capital First Consultants specialize in securing high-value business loans for growth and expansion.

Key Services:

- Financial planning and loan structuring.

- Negotiation of terms and conditions with lenders.

- Post-loan disbursement support.

Why Choose Them: Their team of experts ensures hassle-free processing and offers insights into tax benefits associated with business loans.

4. BizLoan Solutions

Overview: BizLoan Solutions is a dedicated consultancy firm that caters to micro, small, and medium enterprises in Delhi NCR. They focus on making finance accessible to businesses at every stage of growth.

Key Services:

- Assistance with working capital loans and equipment financing.

- Guidance on loan repayment schedules.

- Help with loan renewals and restructuring.

Why Choose Them: Their specialization in MSME loans and strong ties with government-backed schemes make them a go-to consultant for small businesses.

5. SME Lending Consultants

Overview: SME Lending Consultants is renowned for its deep understanding of the challenges faced by small and medium enterprises in securing loans.

Key Services:

- Preparation of business plans and financial projections.

- Assistance with collateral-free loans and unsecured business loans.

- Guidance on improving creditworthiness.

Why Choose Them: Their focus on MSMEs ensures tailored financial solutions that address specific business needs.

6. ProCapital Advisors

Overview: ProCapital Advisors is a full-service financial consultancy that offers strategic solutions for securing business loans. They cater to a diverse range of industries, including manufacturing, retail, and IT.

Key Services:

- Customized loan structuring and planning.

- Support for government and private sector loans.

- Advisory on improving financial statements to boost loan eligibility.

Why Choose Them: Their expertise in financial analysis and strategic planning sets them apart in the competitive consultancy market.

7. EaseMyLoan

Overview: EaseMyLoan simplifies the loan application process for businesses in Delhi NCR by offering a seamless digital experience.

Key Services:

- Online loan application and tracking.

- Instant eligibility checks and document uploads.

- Real-time updates on loan status.

Why Choose Them: Their technology-driven approach ensures quick turnaround times and minimal paperwork.

8. CreditWise Consultants

Overview: CreditWise Consultants focus on empowering businesses by providing comprehensive financial guidance and loan assistance.

Key Services:

- Credit score improvement and financial planning.

- Assistance with both secured and unsecured business loans.

- Tailored solutions for startups and growing businesses.

Why Choose Them: Their emphasis on educating clients about financial management makes them a reliable partner for long-term growth.

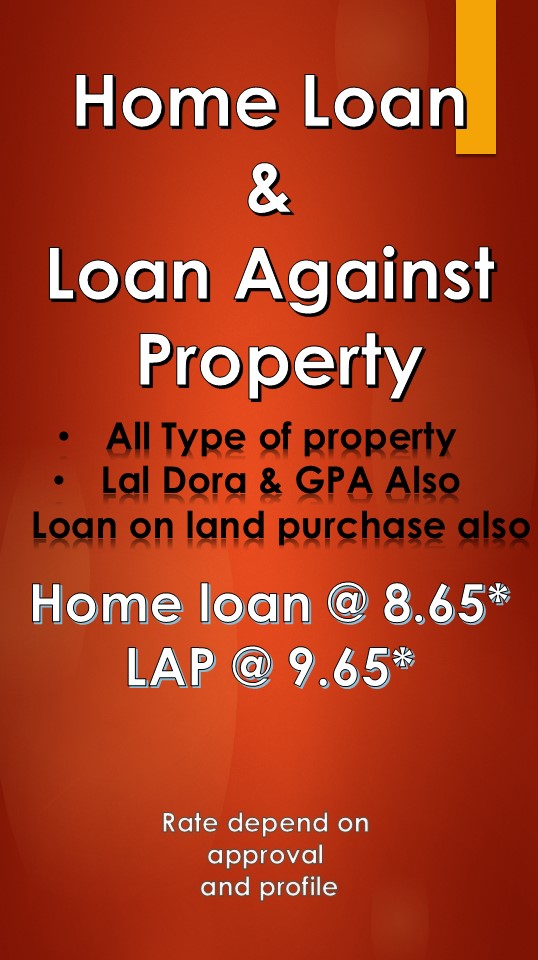

9. Delhi NCR Financial Advisors

Overview: This consultancy offers holistic financial solutions for businesses, specializing in loan acquisition and financial planning.

Key Services:

- Support with term loans, project financing, and overdraft facilities.

- Advisory on leveraging government schemes for MSMEs.

- Assistance with creating financial documentation.

Why Choose Them: Their wide network of banking and financial partners ensures access to diverse loan products.

10. LoanBuddy

Overview: LoanBuddy is a modern consultancy that combines technology with expert advice to assist businesses in securing loans efficiently.

Key Services:

- Digital tools for loan comparison and eligibility assessment.

- Assistance with fast-tracked loan approvals.

- Post-loan support for repayment and restructuring.

Why Choose Them: Their user-friendly platform and expert team make loan acquisition straightforward and stress-free.

Tips for Choosing the Right Consultant

- Understand Your Business Needs: Identify the type of loan and amount required before approaching a consultant.

- Research Consultants: Look for consultants with a proven track record and strong relationships with financial institutions.

- Evaluate Transparency: Choose consultants who are upfront about their fees and processes.

- Check Reviews and Testimonials: Client feedback can provide valuable insights into the consultant’s reliability and efficiency.

Conclusion

Delhi NCR’s dynamic business environment offers immense opportunities for entrepreneurs. With the right guidance, securing a business loan can be a seamless process, enabling businesses to achieve their growth aspirations. The consultants mentioned above are trusted partners for entrepreneurs, offering expert advice and personalized solutions. By choosing the right consultant, businesses can navigate the complexities of loan acquisition and focus on what truly matters—building a successful venture.