Table of Contents

ToggleThe Importance of Maintaining Financial Stability for Home Loan Approval with a Weak Credit Profile

Securing a home loan is one of the most significant financial decisions you’ll make in your lifetime. It requires careful planning, an understanding of the application process, and the ability to present yourself as a responsible borrower. While factors such as income, employment history, and credit score are commonly considered by lenders when assessing your loan application, maintaining overall financial stability is crucial—especially if you have a weak credit profile. A weak credit profile, often reflected by a low credit score or a history of financial mismanagement, can pose significant challenges in securing a home loan. However, it does not necessarily mean that homeownership is out of reach. By maintaining financial stability, you can strengthen your loan application and increase the likelihood of approval, even with a less-than-ideal credit history. This article explores the importance of financial stability in home loan approval and how it can help offset the impact of a weak credit profile.Understanding Financial Stability

Financial stability refers to the ability to manage your finances effectively and meet your financial obligations consistently. It is a reflection of your income, savings, debts, and the overall health of your financial situation. Key components of financial stability include:- Consistent Income: Having a reliable and stable source of income is one of the most important factors in demonstrating financial stability. This shows lenders that you can afford to repay a home loan without falling behind on payments.

- Low Debt-to-Income (DTI) Ratio: A low DTI ratio, which compares your monthly debt payments to your monthly income, signals that you are not overburdened with debt and are capable of managing your finances responsibly.

- Savings and Emergency Funds: Having savings, especially an emergency fund, shows lenders that you can handle unexpected expenses without relying on credit or defaulting on loan payments.

- Asset Management: Effectively managing and building assets—whether through investments, property, or savings—demonstrates financial foresight and responsibility.

Why Financial Stability Matters with a Weak Credit Profile

A weak credit profile can be a significant obstacle to home loan approval. Banks and financial institutions often use credit scores to gauge the risk associated with lending money. A lower score typically reflects a history of missed payments, defaults, or high levels of outstanding debt, which increases the risk for lenders. While a poor credit score may result in higher interest rates or stricter terms, maintaining financial stability can mitigate some of the negative impacts. Here’s why maintaining financial stability matters when applying for a home loan with a weak credit profile:1. Proving Your Ability to Repay the Loan

One of the primary concerns of lenders when dealing with applicants with weak credit is their ability to repay the loan. If your credit history suggests that you have struggled with repayment in the past, maintaining financial stability can reassure the lender that you are capable of managing future obligations. A stable income, a reasonable DTI ratio, and a healthy savings buffer indicate that you have the financial discipline to handle a mortgage. For instance, if your credit score is low due to a few past missed payments or temporary financial hardship, lenders may be more willing to approve your loan if they see that you have steady, reliable income and have been consistently saving over the last several months or years.2. Minimizing the Risk for the Lender

Lenders use the risk of loan default as a major factor when determining approval for home loans. A weak credit score signals higher risk, but demonstrating financial stability can help alleviate this concern. By showing that you have a stable income, manageable debt levels, and a history of savings, you can reduce the lender’s perception of risk. A strong financial foundation suggests that, even though your credit score may be weak, you are less likely to default on your loan. A lender may consider this as a positive sign and approve your application with favorable terms, such as lower interest rates or more flexible repayment plans.3. Increasing Your Loan Eligibility

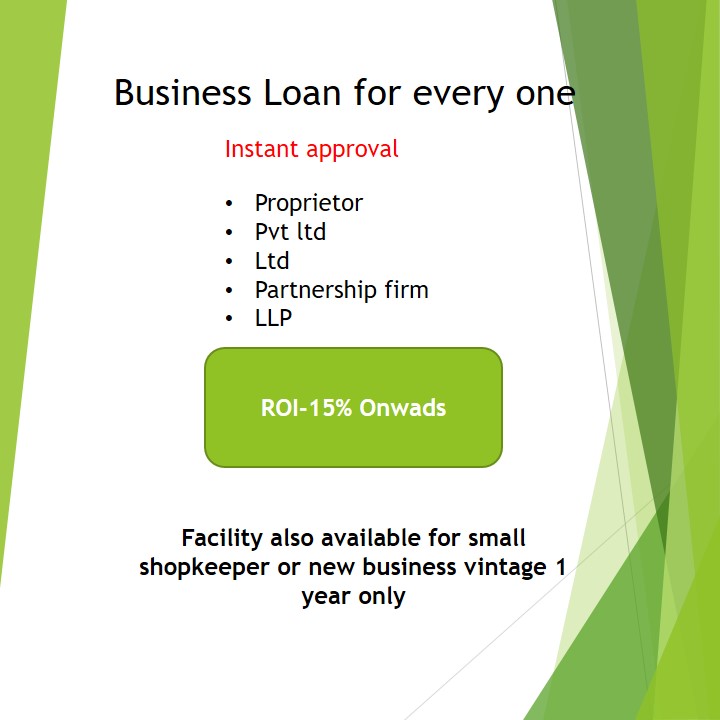

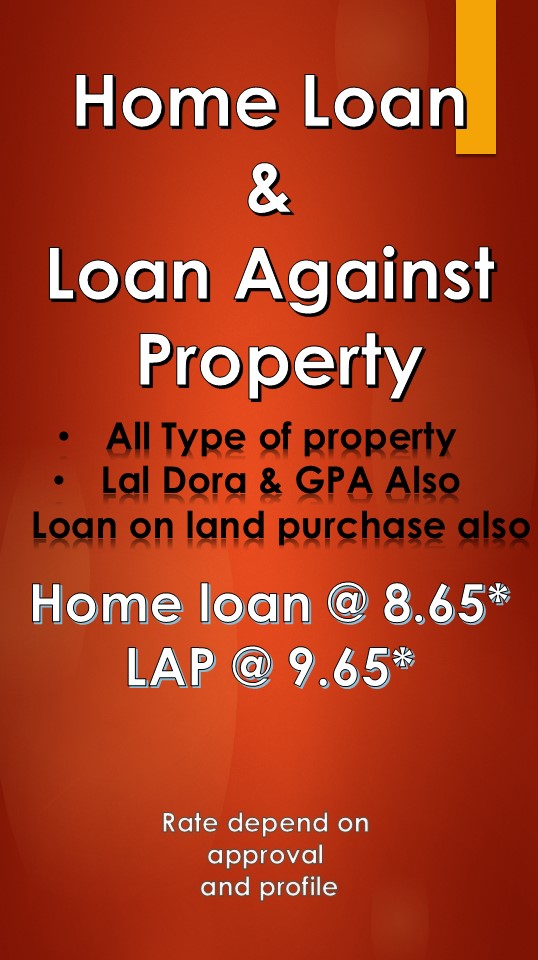

Home loan approval is not just about your credit score. Lenders also evaluate your overall financial health. Maintaining financial stability can increase your eligibility for a larger loan amount, even if your credit score doesn’t meet the traditional threshold for favorable terms. Factors such as income, savings, job stability, and the amount of debt you have will all be considered when determining how much you can borrow. For example, if your credit score is weak but you have a solid income, manageable debt levels, and substantial savings, you may still be eligible for a home loan. Lenders might even offer you a higher loan amount because they see that you can afford the monthly payments.4. Potential for Better Loan Terms

Even with a weak credit profile, you may still be able to secure better loan terms if you demonstrate financial stability. A low credit score often leads to higher interest rates, but a stable financial situation can help you negotiate better terms. For example, if you can make a significant down payment or have substantial assets, lenders may be more inclined to offer you a loan with lower interest rates, fewer fees, and more flexible repayment terms. By presenting a well-rounded financial profile that showcases stability, you signal to the lender that you are a responsible borrower who is committed to managing your finances effectively.5. Lowering the Impact of Past Credit Issues

If your credit score is low due to past financial mistakes, such as missed payments or defaults, maintaining financial stability can help lower the impact of those issues. Lenders are more likely to focus on your current financial health than your past mistakes, especially if you have demonstrated a significant improvement in your financial behavior. For instance, if your credit score is low due to a previous job loss or medical emergency, but you have managed to stabilize your finances by maintaining a consistent income, building savings, and reducing debt, the lender may take a more lenient approach when evaluating your loan application.Key Steps to Maintain Financial Stability for Home Loan Approval

If you have a weak credit profile but want to improve your chances of home loan approval, here are some key steps to maintain and improve your financial stability:- Improve Your Income: Seek ways to increase your income through promotions, side gigs, or investment income. A higher income can improve your loan eligibility and reduce the burden of monthly payments.

- Reduce Debt: Work on paying down high-interest debts, such as credit cards or personal loans. A lower debt burden will improve your DTI ratio and show lenders that you are financially responsible.

- Build Savings: Save for an emergency fund and a substantial down payment. This not only strengthens your application but also demonstrates that you can handle financial emergencies without relying on credit.

- Monitor Your Spending: Be mindful of your spending habits and prioritize savings. A budget can help you manage your finances more effectively and maintain financial stability.

- Avoid New Credit: Refrain from taking on new credit lines or loans while you’re in the process of applying for a home loan. Too many recent inquiries or new debt can negatively affect your credit score and raise red flags for lenders.