Driving Innovation and Empowering Banking: Sandeep Bakshi Shaping the Future of Finance

In an era marked by rapid technological advancements and evolving customer expectations, the banking industry stands at a critical juncture. At the forefront of this transformation is Sandeep Bakshi, the Managing Director and CEO of ICICI Bank, one of India's largest private sector banks. Under his leadership, ICICI Bank has been driving innovation and empowering banking, positioning itself as a key player in shaping the future of finance. This article explores Bakshi's strategic vision, his approach to digital transformation, and the impact of his leadership on the banking sector.

Sandeep Bakshi: A Visionary Leader

Sandeep Bakshi took the helm of ICICI Bank in October 2018, during a period of significant challenges for the bank. With over three decades of experience in the financial services industry, Bakshi brought a wealth of knowledge and a steady hand to guide the bank through turbulent times. His leadership style is characterized by a focus on customer-centricity, operational efficiency, and technological innovation.

Bakshi's vision for ICICI Bank is clear: to create a future-ready financial institution that leverages technology to enhance customer experience and operational efficiency. He believes that the key to staying competitive in the modern banking landscape is to embrace digital transformation while maintaining a strong foundation of trust and reliability.

Digital Transformation: A Strategic Imperative

One of Bakshi's most significant contributions to ICICI Bank has been his relentless focus on digital transformation. Recognizing the transformative potential of technology, he has spearheaded initiatives to digitize the bank's operations and services, ensuring that ICICI remains at the cutting edge of banking innovation.

- Enhancing Customer Experience: Under Bakshi's leadership, ICICI Bank has launched a slew of digital products and services designed to enhance customer experience. The bank's mobile banking app, iMobile, and internet banking platform, ICICI Bank Internet Banking, have been continuously upgraded with new features that make banking more convenient and accessible for customers. From seamless fund transfers and bill payments to personalized financial advice, these platforms offer a comprehensive suite of services that cater to the diverse needs of modern consumers.

- Embracing Artificial Intelligence and Machine Learning: Bakshi has been a strong advocate for integrating artificial intelligence (AI) and machine learning (ML) into the bank's operations. These technologies are used to analyze customer data, predict trends, and personalize services, thereby improving customer engagement and satisfaction. AI-powered chatbots and virtual assistants, for instance, provide round-the-clock customer support, addressing queries and resolving issues in real-time.

- Strengthening Cybersecurity: In an increasingly digital world, cybersecurity is paramount. Bakshi has prioritized strengthening ICICI Bank's cybersecurity framework to protect customer data and ensure secure transactions. The bank employs advanced encryption techniques, multi-factor authentication, and continuous monitoring to safeguard against cyber threats.

- Leveraging Blockchain Technology: ICICI Bank has also been exploring the potential of blockchain technology to enhance transparency and efficiency in transactions. Blockchain's decentralized ledger system can streamline processes such as cross-border payments and trade finance, reducing costs and improving speed.

Empowering Employees and Fostering Innovation

Sandeep Bakshi understands that innovation is not just about technology; it's also about people. He has fostered a culture of innovation within ICICI Bank by empowering employees and encouraging a mindset of continuous improvement.

- Investing in Talent Development: Bakshi has placed a strong emphasis on talent development, recognizing that a skilled and motivated workforce is crucial for driving innovation. The bank has implemented various training programs and initiatives to upskill employees, equipping them with the knowledge and tools needed to thrive in a digital-first environment.

- Encouraging Intrapreneurship: To cultivate a spirit of innovation, Bakshi has encouraged intrapreneurship within the organization. Employees are encouraged to think creatively, propose new ideas, and take ownership of projects that drive the bank's digital agenda. This approach has led to the development of innovative solutions that address customer pain points and enhance operational efficiency.

- Collaboration and Partnerships: Bakshi has also been a proponent of collaboration, both within the organization and with external partners. By fostering a collaborative environment, ICICI Bank has been able to leverage diverse perspectives and expertise to drive innovation. Strategic partnerships with fintech startups, technology firms, and academic institutions have further strengthened the bank's innovation capabilities.

Impact on the Banking Sector

Sandeep Bakshi's leadership and strategic initiatives have had a profound impact on the banking sector, setting new benchmarks for innovation and customer service.

- Setting Industry Standards: ICICI Bank's digital transformation journey under Bakshi's leadership has set new standards for the banking industry. The bank's innovative use of technology and customer-centric approach have inspired other financial institutions to embark on their own digital transformation journeys.

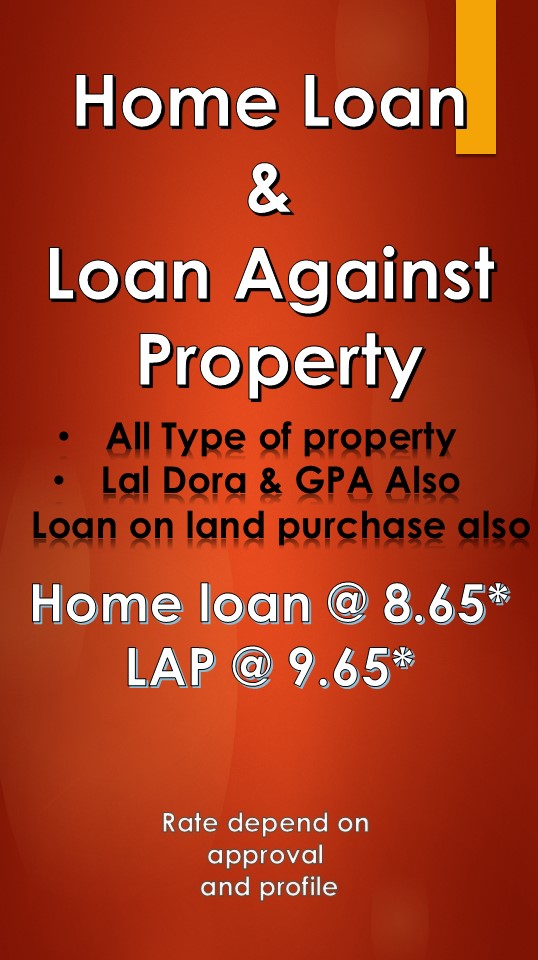

- Promoting Financial Inclusion: Bakshi's vision extends beyond just enhancing customer experience for existing clients. He is also committed to promoting financial inclusion by leveraging technology to reach underserved and unbanked populations. Initiatives such as digital savings accounts, micro-loans, and financial literacy programs are aimed at bringing more people into the formal banking system.

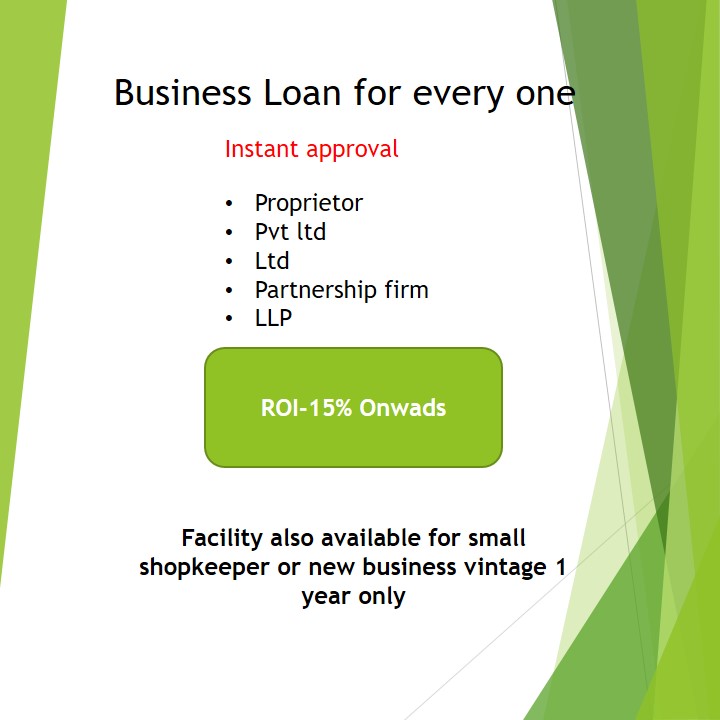

- Driving Economic Growth: By providing innovative financial solutions and improving access to credit, ICICI Bank under Bakshi's leadership has played a pivotal role in driving economic growth. Small and medium-sized enterprises (SMEs), in particular, have benefited from the bank's digital lending platforms, which offer quick and hassle-free access to funding.

- Sustainable Banking Practices: Bakshi is also a strong advocate for sustainable banking practices. ICICI Bank has implemented various initiatives to promote environmental sustainability, such as financing renewable energy projects and adopting green banking practices. These efforts align with Bakshi's vision of creating a bank that not only drives financial growth but also contributes to the well-being of society and the environment.

Conclusion

Sandeep Bakshi's tenure as Managing Director and CEO of ICICI Bank has been marked by a relentless pursuit of innovation and a commitment to empowering banking. His strategic vision, focus on digital transformation, and emphasis on people and culture have positioned ICICI Bank as a leader in the financial sector. By driving innovation and fostering a customer-centric approach, Bakshi is not only shaping the future of ICICI Bank but also setting new benchmarks for the entire banking industry. As the financial landscape continues to evolve, Sandeep Bakshi's leadership will undoubtedly play a crucial role in defining the future of finance.