Funding Opportunities Unveiled: How to Get Business Loans with Infosol Fintech’s Support in Delhi-NCR

Securing

funding is one of the biggest challenges for businesses, especially in the highly competitive and dynamic markets of Delhi-NCR. This bustling metropolitan area is a hub of entrepreneurial activity, where small and medium-sized enterprises (SMEs) strive to innovate and expand. How to Get Business Loans with Infosol Fintech’s Support However, the path to securing a business loan can often be fraught with obstacles. Enter Infosol Fintech, a company dedicated to simplifying the process of obtaining business loans and providing invaluable support to enterprises in the region.

Understanding the Need for Business Loans

For many businesses, accessing external funding is crucial for various reasons. Whether it’s for expanding operations, purchasing new equipment, hiring staff, or simply managing cash flow, a business loan can provide the necessary financial boost. In the context of Delhi-NCR, where the cost of living and doing business is relatively high, the importance of adequate funding cannot be overstated.

The Challenges in Securing Business Loans

Despite the clear need for business loans, many entrepreneurs face significant hurdles in securing them. Traditional banks often have stringent requirements, including extensive documentation, high credit scores, and lengthy approval processes. For many SMEs, these barriers can be insurmountable. Additionally, a lack of financial literacy and understanding of the loan application process can further complicate matters.

Infosol Fintech: Bridging the Gap

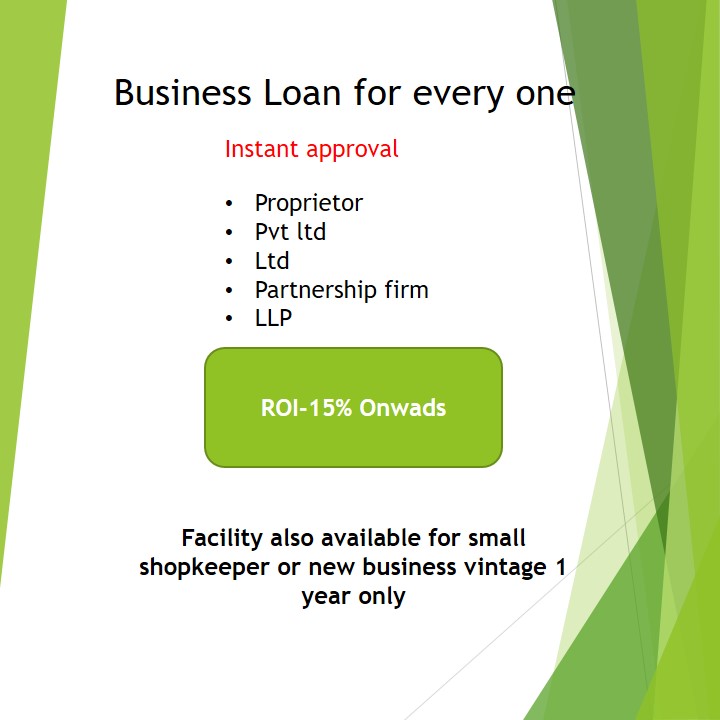

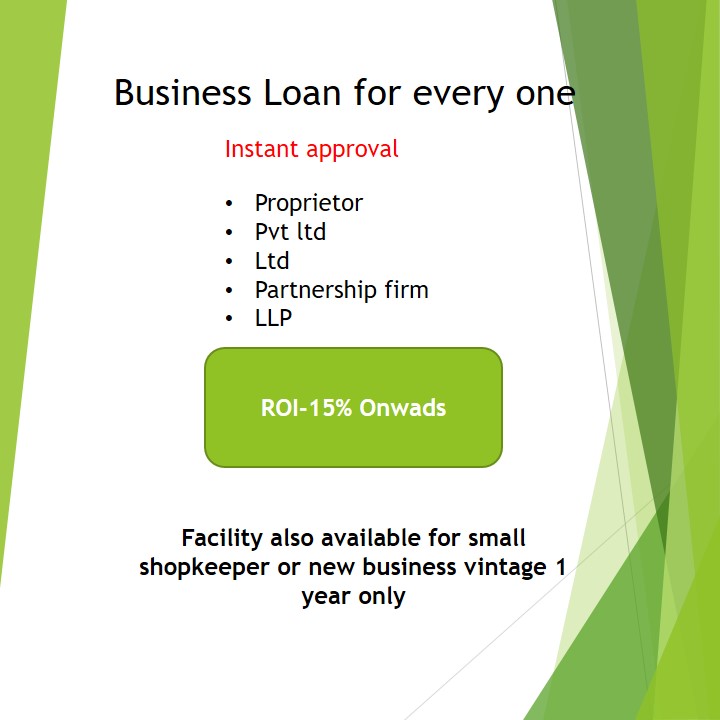

Infosol Fintech has emerged as a game-changer in the business loan landscape of Delhi-NCR. By leveraging technology and a deep understanding of the financial ecosystem, Infosol Fintech aims to bridge the gap between lenders and borrowers. Here’s how Infosol Fintech is making a difference:

1. Simplified Application Process

Infosol Fintech has streamlined the loan application process, making it easier and faster for businesses to apply. By digitizing the application process, Infosol Fintech eliminates the need for cumbersome paperwork and reduces the time required for loan approvals. Applicants can submit their details online, and the platform’s algorithm matches them with the most suitable lenders based on their profiles.

2. Wide Network of Lenders

Infosol Fintech has built a robust network of lending partners, including banks, non-banking financial companies (NBFCs), and peer-to-peer (P2P) lenders. This diverse network ensures that businesses have access to a variety of loan products and competitive interest rates. By partnering with multiple lenders, Infosol Fintech can offer customized loan solutions that meet the specific needs of different businesses.

3. Personalized Financial Advice

One of the standout features of Infosol Fintech is its commitment to providing personalized financial advice. The platform’s experts work closely with business owners to understand their financial needs and goals. Based on this understanding, they offer tailored advice on the best loan products and strategies for securing funding. This personalized approach helps businesses make informed decisions and improves their chances of securing a loan.

4. Credit Score Improvement Programs

Recognizing that many SMEs struggle with poor credit scores, Infosol Fintech offers credit score improvement programs. These programs provide guidance on how to improve credit ratings, including tips on timely repayments, managing credit utilization, and correcting errors in credit reports. By helping businesses improve their credit scores, Infosol Fintech enhances their eligibility for loans and access to better terms and conditions.

5. Educational Resources and Workshops

Infosol Fintech is also dedicated to enhancing financial literacy among entrepreneurs in Delhi-NCR. The company regularly conducts workshops and seminars on various aspects of business financing, including loan application procedures, financial management, and investment strategies. These educational resources empower business owners with the knowledge they need to navigate the financial landscape effectively.

Case Studies: Success Stories with Infosol Fintech

Case Study 1: Expanding a Retail Business

Rohit Sharma, the owner of a small retail business in Delhi, faced challenges when he wanted to expand his operations. Traditional banks rejected his loan applications due to a lack of collateral and a moderate credit score. Rohit turned to Infosol Fintech, where he received personalized advice and was matched with an NBFC willing to offer a loan with flexible terms. With the funding secured, Rohit successfully expanded his store and increased his revenue by 30% within six months.

Case Study 2: Tech Startup Growth

Priya Mehta, an entrepreneur running a tech startup in Gurgaon, needed funding to develop a new product. Despite having a solid business plan, she struggled to find a lender willing to invest in her venture. Infosol Fintech connected her with a P2P lending platform that offered a loan at a competitive interest rate. The funding allowed Priya to launch her product, which quickly gained traction in the market, leading to substantial business growth.

Case Study 3: Manufacturing Unit Upgrade

Amit Verma, who owns a manufacturing unit in Noida, needed a loan to upgrade his machinery and improve production efficiency. Traditional banks required extensive documentation and had long processing times, which Amit could not afford. Infosol Fintech facilitated a quick loan approval through a partner bank, enabling Amit to upgrade his machinery and enhance productivity. The investment paid off, resulting in increased output and profitability.

How to Get Started with Infosol Fintech

Getting started with Infosol Fintech is straightforward. Here’s a step-by-step guide:

Step 1: Visit the Infosol Fintech Website

Start by visiting the Infosol Fintech website, where you can find detailed information about their services and the loan application process.

Step 2: Create an Account

Create an account by providing basic information about your business. This will give you access to the platform’s features and resources.

Step 3: Complete the Application Form How to Get Business Loans with Infosol Fintech’s

Fill out the online application form with details about your business, financial status, and loan requirements. The form is designed to be user-friendly and requires minimal documentation.

Step 4: Get Matched with Lenders

Once your application is submitted, Infosol Fintech’s algorithm will match you with suitable lenders based on your profile. You will receive multiple loan offers to choose from.

Step 5: Consult with Financial Advisors

Take advantage of the personalized financial advice offered by Infosol Fintech’s experts. They will help you understand the loan terms and choose the best option for your business.

Step 6: Secure the Loan

After selecting the most suitable loan offer, complete the necessary formalities to secure the funding. Infosol Fintech ensures a smooth and hassle-free process.

Conclusion

In the competitive business environment of Delhi-NCR, securing a business loan can be a daunting task. However, with the support of Infosol Fintech, businesses can navigate the complexities of the loan application process with ease. By offering a simplified application process, a wide network of lenders, personalized financial advice, credit score improvement programs, and educational resources, Infosol Fintech empowers businesses to achieve their financial goals. Whether you are looking to expand your operations, invest in new technology, or manage your cash flow, Infosol Fintech is your trusted partner in securing the funding you need.