Bajaj Housing Finance’s $782 million public offering opened on Monday, marking the beginning of what promises to be the busiest week for Indian IPOs in 2024. This wave of Initial Public Offerings (IPOs) reflects the fervor of companies looking to seize opportunities in India’s booming stock market. Retail investor enthusiasm is running high, driving interest in a market that has repeatedly broken records.

A Record-Breaking Stock Market

India’s stock market has been on an unprecedented rise in 2024, with record highs being set more than 50 times. This surge has not only attracted the attention of institutional investors but also encouraged retail investors to dive in, seeking returns on their investments. The growing enthusiasm for equities and public offerings is driven by a variety of factors, including India's robust economic growth, improved corporate earnings, and favorable government policies that promote investment in the capital markets.

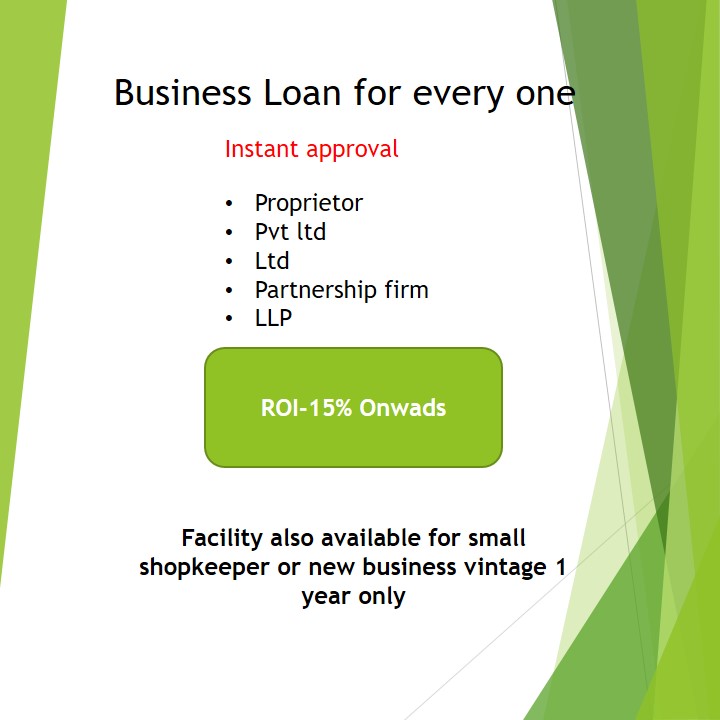

The result? A flood of IPOs, with approximately 200 companies having raised over $7 billion through public offerings so far this year. The list of companies includes high-profile names such as Ola Electric Mobility, the electric vehicle (EV) manufacturer that has made waves with its innovation in the EV space, and Bharti Hexacom, a major player in the telecom industry. The sheer scale and variety of these offerings signal a broader trend: companies across sectors are eager to tap into the liquidity and appetite for growth that defines the current market.

Bajaj Housing Finance IPO: A Significant Milestone

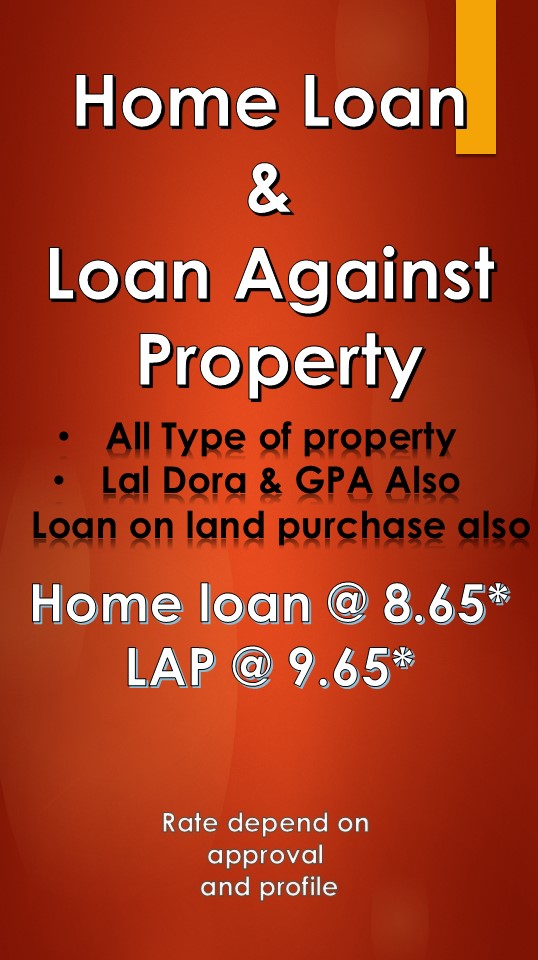

Among this surge of IPOs, Bajaj Housing Finance’s public offering stands out. With a size of $782 million, it is one of the largest public offerings of the year. Bajaj Housing Finance, a subsidiary of Bajaj Finserv, is well-established in the financial sector, providing housing finance and related services to a broad base of customers. The company’s IPO is aimed at expanding its operations, strengthening its balance sheet, and capitalizing on the growing demand for housing loans in India.

The timing of Bajaj Housing Finance's IPO could not be better. The housing market in India has been witnessing a revival post-pandemic, with increased demand for residential properties, lower interest rates, and a shift in consumer preference toward home ownership. These factors have fueled the growth of housing finance companies, making Bajaj Housing Finance’s IPO a compelling proposition for investors.

Moreover, Bajaj Housing Finance benefits from being part of the Bajaj Group, one of India’s most reputable and diversified business conglomerates. The group's strong brand presence, coupled with its financial expertise, positions Bajaj Housing Finance as a trusted name in the housing finance sector.

A Wave of IPOs This Week

Bajaj Housing Finance’s IPO is just one of 16 public offerings set to open for subscription this week, making it the busiest week for IPOs in India in 2024. The rush of companies going public reflects the overall bullish sentiment in the market, where both large and small firms are eager to make their debut on the stock exchange.

One of the other notable IPOs this week comes from Sammaan Capital, a smaller peer of Bajaj Housing Finance. Although smaller in scale, Sammaan Capital’s IPO highlights the diversity of companies seeking to go public, as financial institutions of varying sizes look to raise capital for expansion. This trend underscores the broader growth of India’s financial services industry, which has been thriving amid rising consumer demand for loans, mortgages, and other financial products.

Retail Investor Frenzy: The Key Driver

One of the key drivers behind the booming IPO market in India is the retail investor frenzy. Retail investors have been pouring money into the stock market at an unprecedented rate, spurred by the prospect of high returns and the relative stability of the Indian economy. This surge in retail participation has been facilitated by the increasing penetration of digital investment platforms, which have made it easier for individual investors to participate in IPOs and stock trading.

In addition, the availability of information and financial literacy has improved significantly in recent years, with retail investors now more informed about the workings of the stock market. This has led to a greater appetite for risk, as retail investors are willing to back companies with growth potential, even if they come with higher risks.

The retail frenzy has not only buoyed the stock market but also created opportunities for companies to raise capital at attractive valuations. Companies going public are aware of the strong demand from retail investors, and many have structured their IPOs to cater to this demographic, offering attractive pricing and subscription terms.

The Broader Impact of India’s IPO Boom

India’s IPO boom is not just a reflection of market dynamics; it also has broader implications for the country’s economy. The influx of capital into the stock market is helping companies raise funds for expansion, research and development, and innovation. This, in turn, drives economic growth, creates jobs, and fosters a more dynamic business environment.

Furthermore, the successful listing of companies in sectors such as electric vehicles, technology, and financial services underscores the evolving nature of India’s economy. Traditional industries such as manufacturing and agriculture are still important, but there is a clear shift toward newer, technology-driven sectors that are set to define the future of the Indian economy.

For instance, Ola Electric Mobility’s IPO is a testament to the growing importance of the electric vehicle market in India. As the country pushes toward sustainable energy solutions, companies like Ola are at the forefront of this transition, and their public listings reflect investor confidence in the long-term growth of this sector.

Similarly, the listing of telecom companies like Bharti Hexacom highlights the critical role that telecommunications and digital infrastructure play in India’s economic development. As the demand for data and connectivity continues to rise, companies in this space are likely to benefit from increased investment and growth opportunities.

Challenges Ahead

While the current IPO boom is a positive sign for the Indian stock market and economy, there are potential challenges on the horizon. For one, the global economic environment remains uncertain, with concerns about inflation, interest rate hikes, and geopolitical tensions. These factors could impact investor sentiment and lead to volatility in the stock market.

Moreover, the sheer volume of IPOs in a short period could lead to oversaturation. Investors may become more selective in choosing which IPOs to participate in, and some companies may struggle to attract the necessary capital if they are perceived as less attractive investment opportunities.

Finally, companies going public must deliver on the promises they make during their IPOs. Investors will be closely watching the performance of newly listed companies, and any underperformance could dampen enthusiasm for future offerings.

Conclusion

Bajaj Housing Finance’s $782 million IPO is just the latest in a wave of public offerings that have characterized India’s stock market in 2024. The record-breaking market performance, driven by retail investor enthusiasm, has created an ideal environment for companies to raise capital and expand their operations. While the future looks bright, companies and investors alike must navigate potential challenges as they seek to capitalize on the booming IPO market.