Loan Against Property in Old Delhi: A Comprehensive Guide

Introduction

- Definition of loan against property (LAP)

- Brief overview of Old Delhi and its localities: Civil Lines, Timarpur, GTB Nagar, Rana Pratap Bagh, Model Town, Kamla Nagar, Shastri Nagar, Subzi Mandi, Sadar Bazar Loan Against Property in Old Delhi: A Comprehensive Guide

- Importance of LAP in these regions

Understanding Loan Against Property (LAP)

- What is a LAP?

- Types of properties eligible for LAP

- Purpose of taking a LAP (business expansion, education, medical emergencies, etc.)

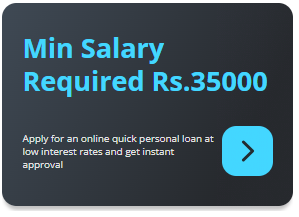

Eligibility Criteria

- General eligibility requirements

- Specific criteria for salaried individuals vs. self-employed professionals

- Impact of credit score on LAP approval

Loan Process

- Application procedure

- Documentation required (property papers, income proof, identity proof, etc.)

- Property valuation process

- Approval and disbursement timeline

Interest Rates and Repayment Loan Against Property in Old Delhi: A Comprehensive Guide

- Overview of current interest rates offered by major banks and financial institutions

- Factors affecting interest rates (property value, borrower’s profile, etc.)

- Repayment tenure options

- Prepayment and foreclosure terms

Locality-wise Insights Loan Against Property in Old Delhi: A Comprehensive Guide

Civil Lines

- Historical significance and real estate trends

- Popular properties eligible for LAP

- Average property prices

Timarpur

- Overview of residential and commercial properties

- Loan offerings specific to Timarpur

- Property market analysis

GTB Nagar

- Proximity to educational institutions and impact on property value

- LAP options for residential vs. commercial properties

Rana Pratap Bagh

- Growth of real estate market

- Preferred areas for LAP

Model Town

- Modern infrastructure and residential appeal

- Key lenders providing LAP in Model Town

Kamla Nagar

- Commercial significance and property trends

- LAP advantages for business owners

Shastri Nagar

- Real estate development and loan prospects

- Popularity among salaried individuals

Subzi Mandi

- Market dynamics and LAP potential

- Analysis of commercial property LAP

Sadar Bazar

- Wholesale market impact on property value

- LAP options for traders and business owners

Benefits of LAP

- Lower interest rates compared to personal loans

- Higher loan amounts

- Flexible repayment options

- Continued property ownership

Risks and Considerations

- Risk of property repossession in case of default

- Impact on credit score

- Proper assessment of repayment capability

Tips for Borrowers

- Thoroughly compare interest rates and terms from different lenders

- Ensure clear property title and proper documentation

- Consult financial advisors for better loan management

Conclusion

- Summary of key points

- Encouragement to consider LAP for financial needs

- Final thoughts on the real estate market in Old Delhi