Indian Taxation and Its Impact on Investments

Introduction

India, with its burgeoning economy and vast market potential, is a significant destination for both domestic and international investors. However, the complex and evolving nature of its taxation system plays a crucial role in shaping investment decisions. Understanding the intricacies of Indian taxation and its impact on investments is essential for any investor looking to navigate this dynamic landscape.

Historical Overview of Indian Taxation

India’s taxation system has undergone substantial changes since independence in 1947. Initially, the system was heavily reliant on indirect taxes, with high import duties and sales taxes. Over the years, India has transitioned towards a more balanced approach, incorporating direct taxes like income tax and corporate tax.

In the early 1990s, India embarked on economic liberalization, leading to significant tax reforms aimed at simplifying the tax structure, broadening the tax base, and reducing tax rates. The introduction of the Goods and Services Tax (GST) in 2017 was a landmark reform, consolidating multiple indirect taxes into a single tax system, thereby reducing the complexity and cascading effect of taxes.

Current Taxation System

India’s current taxation system is divided into direct and indirect taxes. Direct taxes include income tax, corporate tax, and wealth tax, while indirect taxes primarily consist of GST, customs duty, and excise duty.

- Direct Taxes:

- Income Tax: Levied on individual earnings, income tax rates vary based on income slabs, with progressive rates for higher income brackets. Recent reforms have introduced a simplified tax regime with lower rates but fewer exemptions and deductions.

- Corporate Tax: This tax is imposed on the profits of companies. The corporate tax rate has been gradually reduced to make India more competitive globally. Currently, the rate is 22% for domestic companies, with a lower rate of 15% for new manufacturing companies.

- Indirect Taxes:

- Goods and Services Tax (GST): GST is a comprehensive indirect tax levied on the supply of goods and services. It subsumes various state and central taxes, creating a unified tax regime. GST rates vary across different goods and services, with standard rates of 5%, 12%, 18%, and 28%.

- Domestic Investments:

- Ease of Doing Business: Simplification of the tax system, especially through GST, has improved the ease of doing business in India. A unified tax regime reduces compliance costs and administrative burdens, encouraging domestic investments.

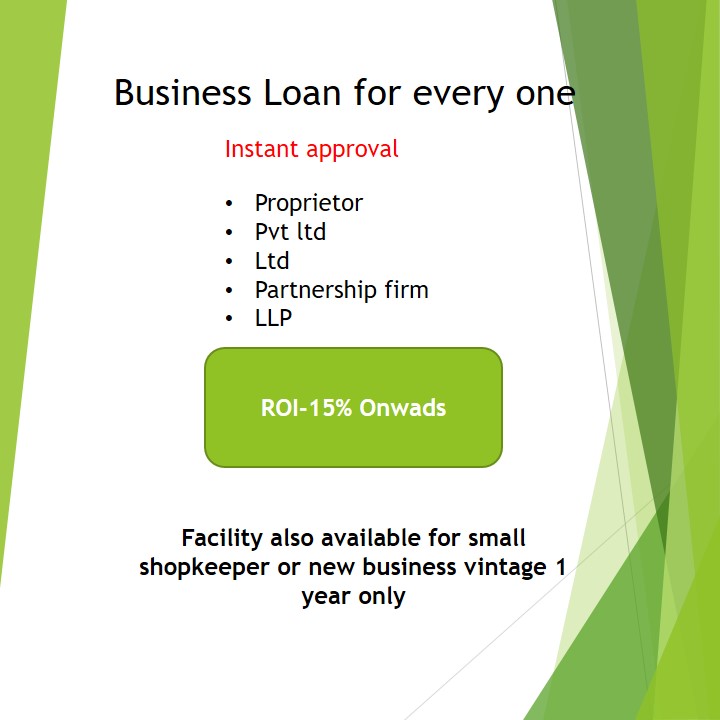

- Corporate Tax Reforms: The reduction in corporate tax rates has made India an attractive destination for businesses, leading to increased investment in the manufacturing and services sectors. Lower tax rates enhance profitability, incentivizing companies to expand operations and invest in new projects.

- Startups and SMEs: Tax incentives and exemptions for startups and small and medium-sized enterprises (SMEs) have fostered innovation and entrepreneurship. The government offers various tax benefits, including tax holidays and reduced compliance requirements, to support the growth of these sectors.

- Foreign Investments:

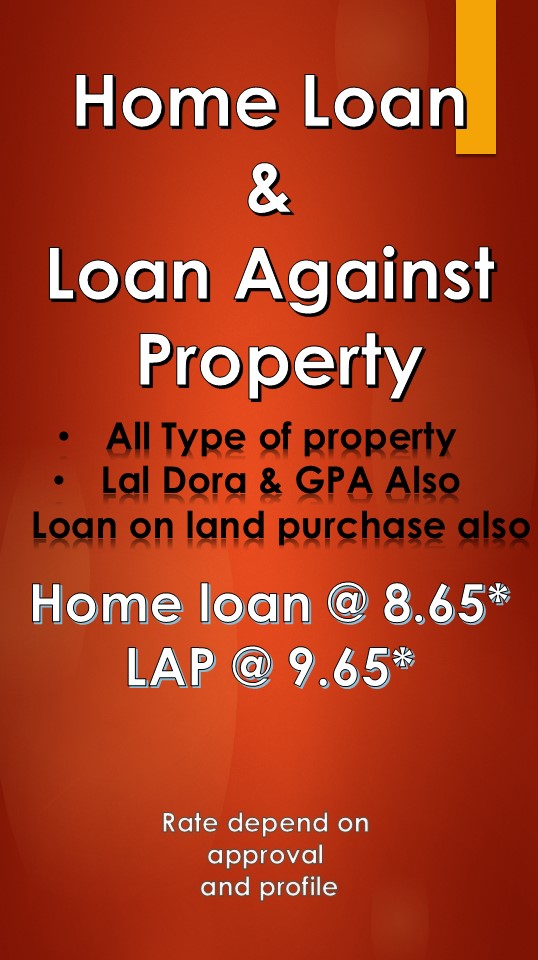

- Foreign Direct Investment (FDI): India’s tax policies significantly impact FDI inflows. Competitive corporate tax rates and the removal of dividend distribution tax have made India an attractive destination for foreign investors. Additionally, bilateral tax treaties and agreements provide clarity and reduce the risk of double taxation, further encouraging FDI.

- Tax Incentives for Special Economic Zones (SEZs): SEZs offer tax exemptions and incentives to attract foreign investments. These zones provide benefits such as exemption from customs duty, GST, and income tax for a specified period, creating a conducive environment for foreign companies to establish operations in India.

- Double Taxation Avoidance Agreements (DTAAs): India has signed DTAAs with various countries to avoid double taxation and provide tax relief to foreign investors. These agreements promote cross-border investments by reducing tax liabilities and providing certainty regarding tax treatment.

- Complexity and Compliance Costs: The tax system, although simplified, remains complex, with multiple tax rates and frequent changes in tax laws. Compliance costs, especially for small businesses, can be burdensome and deter investments.

- Tax Litigation: High levels of tax litigation and disputes create uncertainty for investors. Prolonged legal battles and lack of clarity in tax regulations can discourage both domestic and foreign investments.

- Policy Uncertainty: Frequent changes in tax policies and retrospective amendments create an uncertain investment climate. Investors seek stability and predictability in tax laws to make informed investment decisions.

- Indirect Taxation Burden: While GST has streamlined indirect taxation, the high rates on certain goods and services can impact consumption and investment decisions. High compliance costs associated with GST filings also pose challenges for businesses.

- Digital Taxation: Introduction of equalization levy on digital transactions aims to tax foreign e-commerce companies operating in India. This ensures a level playing field for domestic companies and generates revenue from the digital economy.

- Faceless Assessment and Appeals: The government has introduced faceless assessment and appeals to reduce human intervention and enhance transparency in tax administration. This move aims to minimize corruption and streamline the tax assessment process.

- Reduction in Tax Rates: Continued efforts to reduce corporate tax rates and rationalize GST rates are expected to enhance India’s competitiveness and attract investments. Simplifying tax structures and reducing tax rates can create a more investor-friendly environment.

- Dispute Resolution Mechanisms: Establishing dedicated tax courts and alternative dispute resolution mechanisms can expedite the resolution of tax disputes, providing certainty and confidence to investors.