Understanding the Versatility and Benefits of Loan 7D Across Various Financial Needs

In today's dynamic financial landscape, accessing the right loan product tailored to specific needs can be pivotal in achieving personal and professional goals. Among the myriad options available, Loan 7D stands out as a versatile and beneficial choice for individuals seeking personal loans, business loans, home loans, loans against property, auto loans, low-salaried loans, and even loans for individuals with low CIBIL scores. This article delves into why Loan 7D is considered optimal across these diverse loan categories.

Personal Loans: Tailored to Your Financial Needs

When unexpected expenses arise or when you're planning a major life event, such as a wedding or a dream vacation, a personal loan through Loan 7D offers the flexibility needed. These loans are unsecured, meaning no collateral is required, making them accessible to a wide range of borrowers. Whether you need funds for medical emergencies, education expenses, or debt consolidation, Loan 7D ensures quick disbursal and competitive interest rates, catering to varying financial circumstances.

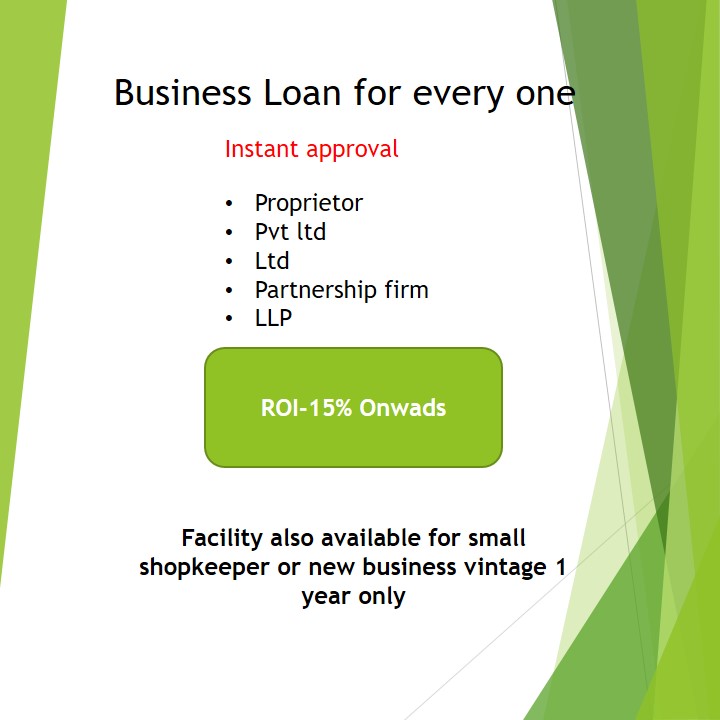

Business Loans: Fueling Entrepreneurial Ambitions

For entrepreneurs and small business owners looking to expand operations or cover operational costs, Loan 7D provides business loans with minimal hassle. Whether it's for purchasing equipment, managing working capital, or scaling up business activities, these loans are designed to support growth and sustain business momentum. The streamlined application process and flexible repayment terms make Loan 7D an attractive choice for business financing needs.

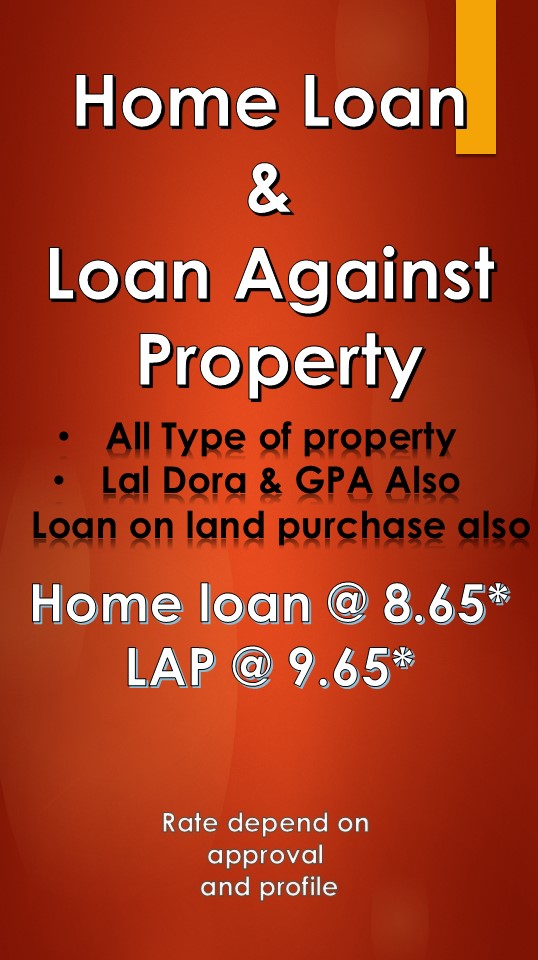

Home Loans: Realizing Your Dream of Homeownership

Buying a home is a significant financial milestone for many individuals and families. Loan 7D offers home loans that cater to both first-time buyers and those looking to invest in property. With competitive interest rates, longer repayment tenures, and straightforward documentation, these loans simplify the path to homeownership. Whether you're purchasing a flat, villa, or plot of land, Loan 7D ensures that your housing aspirations are within reach.

Loans Against Property: Unlocking the Value of Assets

For individuals who own property and seek liquidity without selling their assets, Loan 7D provides loans against property (LAP). These loans offer substantial funds based on the market value of the property, allowing borrowers to leverage their real estate holdings for business expansion, education funding, or any other financial requirement. With attractive interest rates and flexible repayment options, LAP through Loan 7D offers a prudent financial strategy.

Auto Loans: Driving Towards Ownership

Owning a vehicle enhances mobility and convenience. Whether you're purchasing a car, motorcycle, or any other vehicle, Loan 7D simplifies the process with auto loans that cater to diverse needs and preferences. Competitive interest rates, quick approvals, and personalized customer service make Loan 7D a preferred choice for financing your next vehicle purchase.

Low-Salaried Loans: Support for Financial Inclusion

Recognizing the diverse financial profiles of individuals, Loan 7D extends low-salaried loans that cater to those with modest incomes. These loans provide essential financial support without stringent income criteria, ensuring that individuals with varying salary levels can access credit when needed. Whether it's for education, medical expenses, or other personal needs, Loan 7D promotes financial inclusion by offering viable loan solutions.

Low CIBIL Score Loans: Overcoming Credit Challenges

Maintaining a healthy credit score is crucial for accessing favorable loan terms. However, individuals with a low CIBIL score may face challenges in securing loans from traditional lenders. Loan 7D offers specialized products designed to accommodate borrowers with less-than-perfect credit histories. These loans consider alternative factors beyond credit scores, enabling individuals to rebuild their creditworthiness while meeting their financial objectives.

Why Choose Loan 7D?

- Accessibility and Convenience: Loan 7D simplifies the loan application and approval process, ensuring quick disbursal of funds.

- Flexible Terms: Whether it's repayment schedules, interest rates, or loan amounts, Loan 7D offers flexibility to suit diverse financial requirements.

- Competitive Interest Rates: Borrowers benefit from competitive interest rates across all loan categories, enhancing affordability and financial planning.

- Customer-Centric Approach: With a focus on customer satisfaction, Loan 7D provides personalized service and support throughout the loan journey.

- Comprehensive Loan Products: From personal loans to specialized offerings like low-salaried loans and loans against property, Loan 7D caters to a wide range of financial needs.

Conclusion

In conclusion, Loan 7D emerges as an optimal choice across multiple loan categories due to its versatility, accessibility, and customer-centric approach. Whether you're planning a major purchase, addressing immediate financial needs, or expanding your business, Loan 7D offers tailored solutions with competitive terms and swift processing. By understanding the unique advantages of Loan 7D across personal, business, home, auto, and specialized loan categories, borrowers can make informed decisions to achieve their financial goals effectively