Personal Loans in Adarsh Nagar, Pipal Thala, Bazar Sitaram, Pahar Ganj, Daryaganj, Jama Masjid, Ballimaran, Quasabpura, Chandni Chowk, Civil Lines: A Comprehensive Guide

Introduction

In the bustling city of Delhi, neighborhoods like Adarsh Nagar, Pipal Thala, Bazar Sitaram, Pahar Ganj, Daryaganj, Jama Masjid, Ballimaran, Quasabpura, Chandni Chowk, and Civil Lines are vibrant hubs with diverse communities and thriving businesses. For residents of these areas, managing personal finances effectively is crucial, especially when unexpected expenses arise. Personal loans offer a flexible solution to meet various financial needs, from home renovations to medical emergencies. This article explores the availability, benefits, and application process of personal loans in these prominent neighborhoods of Delhi.

Understanding Personal Loans

A personal loan is an unsecured loan provided by banks, non-banking financial companies (NBFCs), or online lenders. It is typically used to finance immediate expenses such as home repairs, education, travel, medical bills, debt consolidation, or any other personal requirement. Personal loans are characterized by fixed interest rates, structured repayment schedules, and no requirement for collateral, making them accessible to a wide range of borrowers.

Benefits of Personal Loans

- No Collateral Required: Unlike secured loans, personal loans do not require any collateral, making them suitable for individuals who may not possess assets such as property or gold.

- Quick Disbursal: Personal loans often have a streamlined approval process, with funds disbursed quickly after approval, sometimes within a few days, depending on the lender's policies and documentation.

- Flexible Use: Borrowers have the flexibility to use personal loan funds for various purposes, including emergencies, planned expenses, or debt consolidation, without restrictions from the lender.

- Structured Repayment: Personal loans come with fixed monthly installments (EMIs), allowing borrowers to plan their budget effectively and manage repayments without surprises.

- Interest Rates: Compare interest rates offered by different lenders to find the most competitive option. Lower interest rates can significantly reduce the overall cost of borrowing.

- Loan Amount: Assess your financial needs and borrowing capacity to determine the appropriate loan amount. Lenders may have minimum and maximum loan limits based on income and creditworthiness.

- Repayment Terms: Understand the repayment tenure offered by each lender. Longer tenures may result in lower EMIs but higher total interest payments over the loan term.

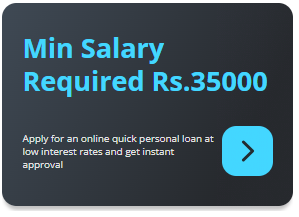

- Eligibility Criteria: Check the eligibility requirements of lenders, including age, income stability, employment status, credit score, and residential stability. Meeting these criteria enhances your chances of loan approval.

- Documentation: Gather necessary documents such as identity proof (Aadhaar card, passport, PAN card), address proof (utility bills, rental agreement), income proof (salary slips, bank statements), and any other documents required by the lender.

- Online Application: Many lenders offer the convenience of online application through their websites or mobile apps. Fill out the application form with accurate details and upload the required documents.

- Verification and Approval: The lender will verify your application and documents. They may conduct a credit check to assess your creditworthiness. Upon approval, you will receive a loan offer detailing the loan amount, interest rate, and repayment terms.

- Disbursal of Funds: After accepting the loan offer, the funds will be disbursed directly to your bank account. Ensure that you provide correct banking details for seamless disbursal.

- Convenience: Personal loans offer convenience with minimal documentation and quick disbursal, making them ideal for urgent financial needs.

- Financial Flexibility: Borrowers can use personal loan funds for any purpose without restrictions, providing financial flexibility and control.

- Competitive Rates: With multiple lenders operating in Delhi, residents can benefit from competitive interest rates and favorable loan terms by comparing offers.

- Emergency Coverage: Personal loans provide a safety net for unforeseen expenses, ensuring that residents of these neighborhoods can manage financial emergencies effectively.