Secured vs. Unsecured Loans: A Deep Dive into India’s Credit Landscape

India's credit landscape is multifaceted, offering a variety of loan products tailored to meet diverse financial needs. Two primary categories of loans dominate this landscape: secured and unsecured loans. Both have distinct features, benefits, and risks. This article explores these loan types in depth, examining their implications for borrowers and the broader financial ecosystem in India.

Understanding Secured Loans

Secured loans are those backed by collateral, which could be any asset like property, gold, or even fixed deposits. This collateral reduces the lender's risk, allowing them to offer more favorable terms to the borrower.

Common Types of Secured Loans

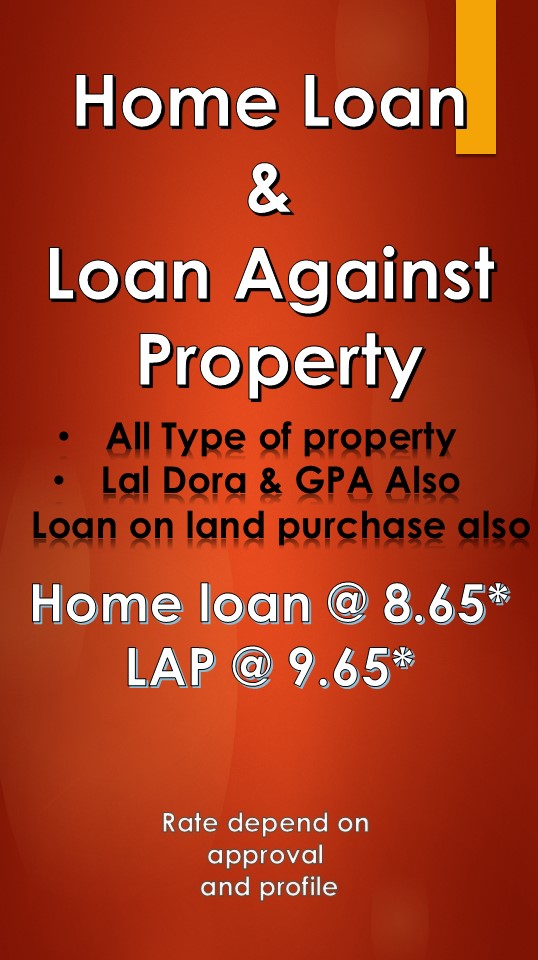

- Home Loans: These are among the most prevalent secured loans in India, allowing individuals to purchase or construct homes. The property being purchased serves as collateral.

- Car Loans: These loans are used to finance the purchase of a vehicle, with the vehicle itself serving as collateral.

- Gold Loans: Here, borrowers pledge gold ornaments or coins to obtain loans. Given the high liquidity and value stability of gold, these loans are popular in India.

- Loan Against Property (LAP): Borrowers can leverage their real estate assets to secure a loan, often used for business expansion, education, or personal needs.

Advantages of Secured Loans

- Lower Interest Rates: Due to the reduced risk for lenders, secured loans typically come with lower interest rates compared to unsecured loans.

- Higher Loan Amounts: The presence of collateral allows borrowers to access larger loan amounts.

- Longer Repayment Terms: Secured loans often offer longer repayment tenures, making them more manageable for borrowers.

- Credit Score Flexibility: Since the loan is backed by an asset, lenders might be more lenient with the credit score requirements.

Risks of Secured Loans

- Risk of Asset Loss: Failure to repay the loan can result in the loss of the collateralized asset.

- Stringent Approval Process: The valuation and verification of collateral can make the approval process lengthier and more complex.

Unsecured Loans Explained

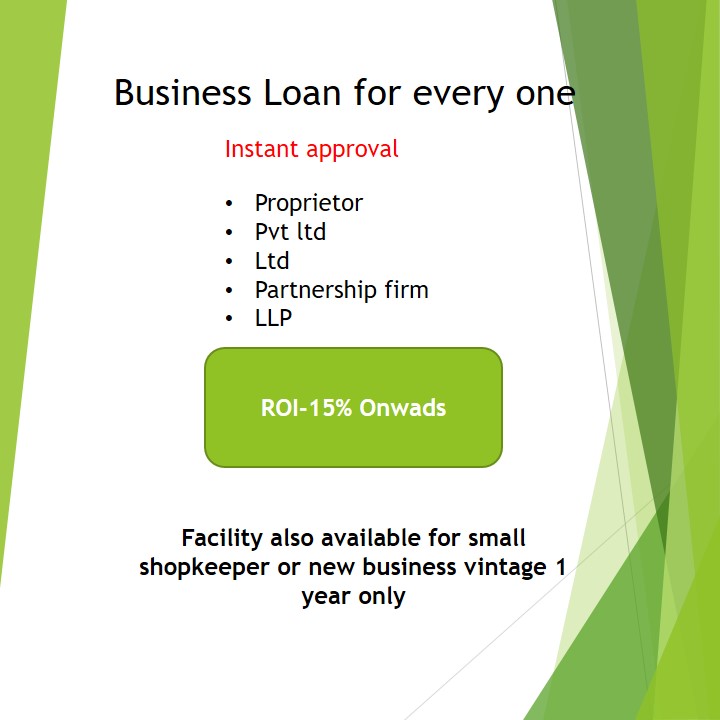

Unsecured loans do not require any collateral, relying solely on the borrower's creditworthiness and financial history. These loans typically carry higher interest rates due to the increased risk for the lender.

Common Types of Unsecured Loans

- Personal Loans: These are multipurpose loans that can be used for various needs like medical emergencies, travel, or home renovations.

- Credit Cards: While technically not loans, credit cards offer a revolving line of credit that can be used for purchases and cash advances.

- Education Loans: These loans help finance higher education expenses, often relying on the student’s future earning potential rather than collateral.

- Consumer Durable Loans: These are used to purchase household appliances and electronics on credit.

Advantages of Unsecured Loans

- Quick Approval: The absence of collateral simplifies the approval process, leading to faster disbursal of funds.

- Flexibility: Unsecured loans are versatile, catering to a wide range of financial needs.

- No Risk to Assets: Borrowers do not risk losing any assets in case of default.

- Simplified Process: The documentation and processing requirements for unsecured loans are generally less stringent.

Risks of Unsecured Loans

- Higher Interest Rates: To compensate for the higher risk, lenders charge higher interest rates on unsecured loans.

- Strict Eligibility Criteria: Lenders place greater emphasis on credit scores and income stability, making it harder for some applicants to qualify.

- Lower Loan Amounts: Without collateral, the loan amounts offered are usually lower compared to secured loans.

- Shorter Repayment Tenures: Unsecured loans often come with shorter repayment periods, increasing the monthly repayment burden.

The Indian Credit Landscape

India's credit market has evolved significantly, with both secured and unsecured loans playing vital roles in economic growth. Understanding the trends and dynamics of these loan types can help borrowers make informed financial decisions.

Current Trends

- Increasing Popularity of Personal Loans: The demand for personal loans has surged due to their convenience and the rise of fintech companies offering quick disbursal.

- Growth in Digital Lending: Digital platforms are transforming the lending process, making it more accessible and efficient, especially for unsecured loans.

- Home Loan Market Expansion: Government initiatives like Pradhan Mantri Awas Yojana (PMAY) have boosted the home loan market, making housing more affordable.

- Gold Loans as a Lifeline: During economic downturns, gold loans have provided a crucial financial lifeline for many households.

Challenges in the Credit Market

- High Non-Performing Assets (NPAs): The banking sector has struggled with high NPAs, particularly in the secured loan segment, affecting overall credit health.

- Credit Access for SMEs: Small and Medium Enterprises (SMEs) often face difficulties accessing credit, especially unsecured loans, due to perceived risks by lenders.

- Regulatory Hurdles: Changes in regulations and compliance requirements can impact the availability and cost of credit.

Making the Right Choice

Choosing between secured and unsecured loans depends on several factors, including the borrower’s financial situation, loan purpose, and risk appetite. Here are some considerations to keep in mind:

- Purpose of the Loan: Secured loans are suitable for large, long-term investments like home purchases, while unsecured loans are ideal for immediate, short-term needs.

- Interest Rates: Compare interest rates and calculate the total cost of borrowing over the loan tenure.

- Repayment Capacity: Assess your ability to meet monthly repayments without straining your finances.

- Credit Score: A higher credit score can enhance your eligibility for unsecured loans at favorable terms.

- Collateral Availability: If you have valuable assets, secured loans can offer better terms. Conversely, unsecured loans are preferable if you lack collateral or do not wish to risk your assets.

Conclusion

India's credit landscape offers a diverse array of secured and unsecured loan options, each with unique benefits and challenges. By understanding the intricacies of these loan types, borrowers can make informed decisions that align with their financial goals and circumstances. Whether opting for the security of collateral-backed loans or the flexibility of unsecured loans, prudent financial planning and responsible borrowing remain key to navigating India’s dynamic credit market successfully.