Unlocking Financial Possibilities: Instant Personal Loans Up to ₹1,00,000 for Low CIBIL Scores in Delhi NCR

In the bustling and ever-growing region of Delhi NCR, financial needs can arise unexpectedly. Whether it’s a medical emergency, a sudden travel plan, or a long-awaited home improvement project, having access to quick and reliable financial support is crucial. However, for individuals with low CIBIL scores, obtaining a personal loan can be a daunting challenge. This article delves into how you can unlock financial possibilities by securing instant personal loans of up to ₹1,00,000, even with a low CIBIL score, in Delhi NCR.

Understanding CIBIL Scores

CIBIL scores, issued by the Credit Information Bureau (India) Limited, range between 300 and 900 and serve as a barometer for a person’s creditworthiness. A score below 650 is generally considered low, which can hinder the process of getting loans approved by traditional banks. However, a low CIBIL score does not have to be a financial dead-end. Understanding how to navigate through this challenge can open doors to essential funds when you need them most.

The Financial Landscape for Low CIBIL Scores

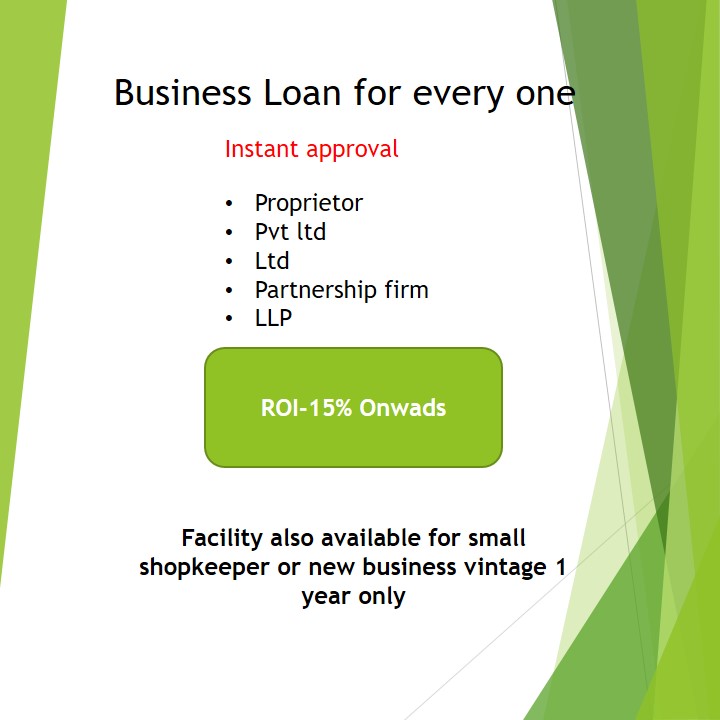

Traditional banking institutions often view low CIBIL scores as a significant risk factor, leading to either rejection of loan applications or approval at very high interest rates. However, the financial landscape is evolving. Non-Banking Financial Companies (NBFCs) and fintech startups are stepping in to fill the gap, offering more flexible and inclusive financial solutions.

Instant Personal Loans: A Boon for Low CIBIL Scores

Instant personal loans are unsecured loans that provide quick financial assistance without the need for extensive paperwork or a lengthy approval process. For those with low CIBIL scores, these loans are particularly beneficial due to their flexible eligibility criteria and quick disbursement.

Key Features of Instant Personal Loans for Low CIBIL Scores

- Quick Approval and Disbursement: Many lenders offer approval within a few hours and disburse the loan amount within 24 to 48 hours, making it an ideal solution for urgent financial needs.

- Flexible Eligibility Criteria: Unlike traditional loans, instant personal loans have less stringent eligibility requirements, focusing more on the borrower’s current income and repayment capacity rather than their credit history.

- No Collateral Required: These loans are unsecured, meaning you don’t need to pledge any assets to secure the loan amount.

- Competitive Interest Rates: While the interest rates may be slightly higher compared to traditional loans, they are still competitive and can be managed effectively with proper financial planning.

- Minimal Documentation: The application process is streamlined, requiring minimal documentation such as identity proof, address proof, and income proof.

Applying for an Instant Personal Loan in Delhi NCR

The process of applying for an instant personal loan in Delhi NCR is straightforward, especially with the advent of digital platforms. Here’s a step-by-step guide to help you navigate through it:

- Research Lenders: Identify NBFCs and fintech lenders that specialize in offering loans to individuals with low CIBIL scores. Compare their interest rates, loan terms, and customer reviews.

- Check Eligibility: Each lender has specific eligibility criteria. Ensure you meet these requirements before proceeding with the application. Common criteria include being an Indian citizen, aged between 21 to 60 years, and having a stable source of income.

- Gather Documentation: Prepare the necessary documents such as Aadhaar card, PAN card, bank statements, salary slips, and address proof. Having these ready can expedite the application process.

- Apply Online: Most lenders offer an online application process. Fill in the required details accurately and upload the necessary documents.

- Await Approval: Once your application is submitted, the lender will review your details. If approved, you will receive the loan agreement for your consent.

- Receive Funds: Upon signing the agreement, the loan amount will be disbursed directly to your bank account, usually within 24 to 48 hours.

Tips to Improve Your Loan Approval Chances

While obtaining a loan with a low CIBIL score is possible, taking certain steps can improve your chances of approval and secure better terms:

- Maintain a Steady Income: A stable job or consistent source of income reassures lenders of your repayment capability.

- Showcase Other Financial Strengths: Highlighting assets, investments, or other financial commitments can positively influence the lender’s decision.

- Opt for a Lower Loan Amount: Applying for a smaller loan amount reduces the risk for the lender and increases your chances of approval.

- Consider a Co-applicant: Having a co-applicant with a good credit score can significantly boost your loan approval prospects.

- Improve Your CIBIL Score: While this is a long-term strategy, consistently repaying existing debts, avoiding new credit applications, and maintaining a healthy credit utilization ratio can gradually improve your CIBIL score.

Reputable Lenders in Delhi NCR for Instant Personal Loans

Several NBFCs and fintech companies cater to individuals with low CIBIL scores in Delhi NCR. Some of the reputable lenders include:

- Bajaj Finserv: Known for its quick disbursal and flexible terms, Bajaj Finserv offers personal loans up to ₹25 lakhs, even to those with low credit scores.

- MoneyTap: A fintech lender providing instant personal loans up to ₹5 lakhs with minimal documentation and quick approval process.

- PaySense: Offers personal loans up to ₹5 lakhs with a simple application process and quick disbursal.

- Fullerton India: Known for its tailored financial solutions, Fullerton India provides personal loans with competitive interest rates and flexible repayment options.

Conclusion

Navigating financial challenges with a low CIBIL score can be difficult, but it’s not impossible. The emergence of NBFCs and fintech companies has opened up new avenues for obtaining instant personal loans in Delhi NCR. By understanding the features, following the application process diligently, and taking steps to improve your financial profile, you can unlock financial possibilities and secure the funds you need. Remember, a low CIBIL score is not the end of the road; with the right approach and resources, you can overcome financial hurdles and achieve your goals